Do not value money for any more nor any less than it's worth. It is a good servant but a bad master.

- Alexandre Dumas Tweet

The word wealth originated around 1250 AD as “weal”, meaning a sound, healthy or prosperous state. The next progression was “welth”, meaning well-being. Both are broad terms encompassing all aspects of our lives. Since then, the definition has narrowed considerably to what it is today; an abundance of valuable material possessions or money.

This narrow view of wealth has contributed to the financialization & consumerization of our economy, and our lives.

Consumerization is the preoccupation with acquiring ever-increasing amounts of goods and services. Although we focus on financialization in this article, please understand that consumerism, materialism and financialization go hand in hand.

Summary

- The concept of wealth has been narrowed to focus on the accumulation of money and things, which has contributed to the financialization of our lives.

- Financialization is the process of the financial sector (banking, insurance, investment, real estate etc.) taking over a larger and larger share of the world’s income at the expense of the real producers.

- The removal of financial regulations, such as the Glass-Steagall act and the Commodity Futures Modernization act, opened the flood gates.

- The primary effects of financialization:

- Consolidation within the financial sector and the rise of “too big to fail” financial institutions.

- Changes in the behavior of non-financial firms.

- Explosion of debt – the hook

- Rising asset values – the line & sinker

- Rising inequality – Both income & asset inequality

- We must redefine our concept of wealth if we are to break this self-reinforcing cycle

- The 3 pillars of Wealth-being:

- Investment – the source of all wealth

- Holistic approach to health – health is wealth!

- Freeing up time – The wasting of time is possibly the most expensive thing you can do.

What is financialization?

The term financialization refers to the process of the financial sector (banking, insurance, investment, real estate etc.) taking over a larger and larger share of the world’s income at the expense of the real producers.

More specifically, financialization is:

- The deregulation of financial markets and other pro financial policies

- The excessive moving of money around to generate fees and paper profits

- The reckless use of debt to buy assets

- The spread of complex and risky financial products and services (Financial Engineering)

- The focus on short-term profits at the expense of long-term productive investment

The process of financialization

It starts with lobbying to breakdown financial regulation. The Glass-Steagall act, which put several rules in place to separate commercial from investment banking, was slowly dismantled. First, 5% of commercial bank revenues could come from investment banking activities. That was expanded to 10% of revenues and eventually 25% in 1996.2 The most ridiculous example of deregulation occurred in 2000. The Commodity Futures Modernization Act prevented the regulation of over-the-counter derivatives contracts. Instead, the “SEC proposed a system of voluntary regulation….. allowing investment banks to hold less capital in reserve and increase leverage.”¹ Derivatives are still largely unregulated to this day.

As the laws are changed to remove restrictions, profits skyrocket leading to more and more firms entering the market. The problem is, firms will never be able to fund their operations using only the assets they have on their balance sheet. The returns would be too low to meet the demands of wall street. That’s where debt comes in. It allows them to use less of their own money, make enormous returns, pay back (or better yet, sell off) the loans, and keep the profits. The loosening of lending standards and the use of massive amounts of debt to fund excessive financial risk taking is justified through the argument that, “if I don’t do it then someone else will.”

The focus turns to what other products or processes could be offered to take advantage of such a booming environment. Ideas such as private equity and the securitization of loans are born and the flow of money into these markets continues its meteoric rise.

This next part is the most clever. As money flows into these new financial products, the prices of financial assets start to rise. Because most people have at least some of their savings in assets such as stocks, bonds and real estate, the increase in prices creates the illusion that they are better off because of these new processes. This is called the “Wealth Effect“. Consequently, the financial interests of the masses become aligned with the interests of the financial firms. At this point, everyone is reaping the rewards, and nobody has the will to shut it down or at least slow it.

The cycle of reduced regulation leading to an explosion of debt, financial engineering and rising asset prices feeds back on itself with the financial firms now able to make the case that financial markets should be deregulated even further because, “can’t you see that everyone’s wealthier now!” The process continues until it doesn’t for any number of reasons.

For a more in depth look into the timeline of financial deregulation in the 1970’s & 80’s, I find this paper the most helpful.

the effects of financialization

The underlying effects of financialization are concentration within the financial sector, changes in the behavior of non-financial firms, and an explosion in debt and asset prices. all of these lead to increasing financial inequality. It’s exactly what we see today.

Concentration within the financial sector leading to "Too big to fail" financial institutions

Originally, banks were not allowed to expand across state lines. Starting around 1980, states began to loosen these restrictions. This set off a 20+ year trend of larger banks buying up their smaller competitors for their deposit base, technology, brand, location and to squash competition.

Starting with the Citicorp and Travelers merger in 1998, and the eventual repealing of the Glass-Steagall Act in 1999, banks began acquiring and merging with investment/brokerage firms. They could now profit off the origination of loans and then profit off the securitization and sale of the same loans, wiping their grubby hands clean of any direct risk from a default.

Banks had been lobbying for a loosening of Glass-Steagall restrictions since the 1960’s!2

With their massive size, such behemoths became “too big to fail”. As of 2014, the 5 largest banks (the top 0.1% out of 6,509 total institutions) controlled 45% of total assets.4

Changes in the behavior of non-financial firms

As the culture of financialization gained steam, the focus became short term profits and the maximization of shareholder returns. Investment in long-term productivity and output took a back seat to moving money through the financial system.

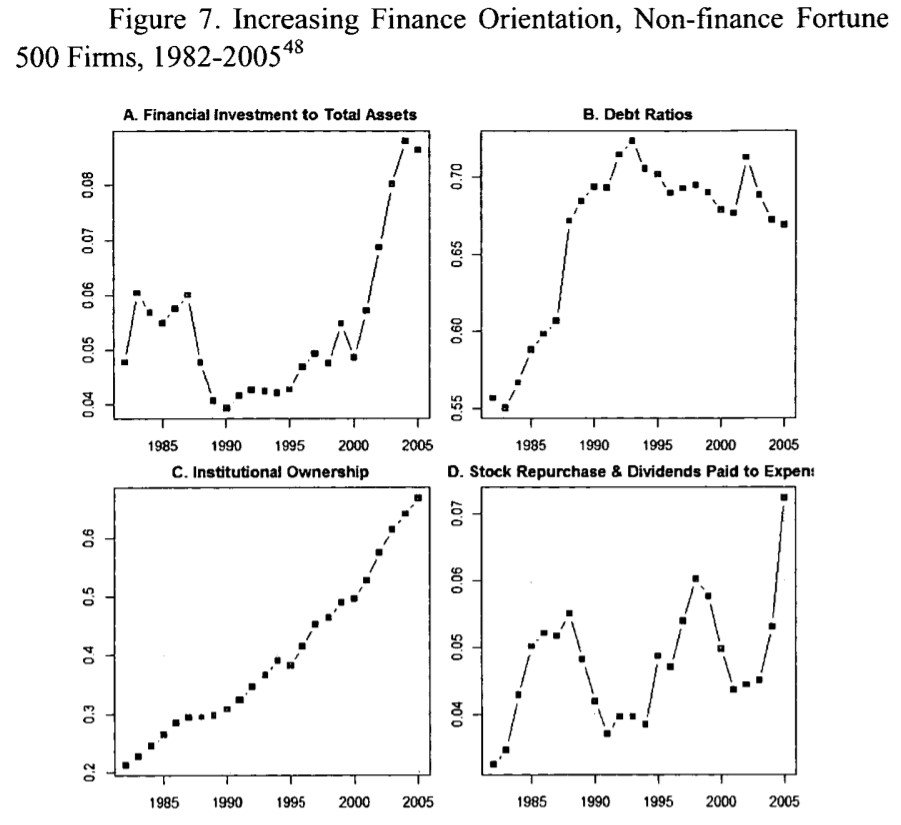

“Established [non-financial] firms [became] less and less treated as production units, but as bundles of tradable assets. Profits flow increasingly from financial investments, rather than trade in goods and services.”3

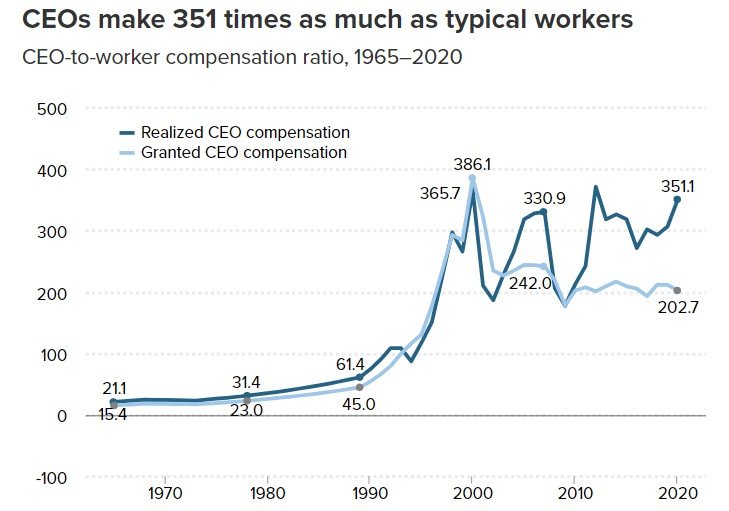

This short-term focus on shareholder returns also led to the explosion of stock options and other awards added to already lavish executive pay.

Stock options incentivize a focus on increasing the stock price as much as possible and as quickly as possible. Once the share price is above the strike price, executives can sell and pad their pockets with additional income.

Even worse, if you hold the stock for at least one year, you only have to pay 20% in federal capital gains taxes. Compare that to the 37% you’d have to pay if it were treated as ordinary income. This is a lower rate than someone making $80k per year pays on their income. In other words, you could be making $10 million per year, be given $1 million in stock options for free, recognize a $1 million profit by selling the shares, and pay as much tax as someone making $80k per year!

Needless to say, such schemes worsen the inequality between executive pay and that of the typical worker.

Increasing debt and asset prices: The hook, line and sinker of financialization

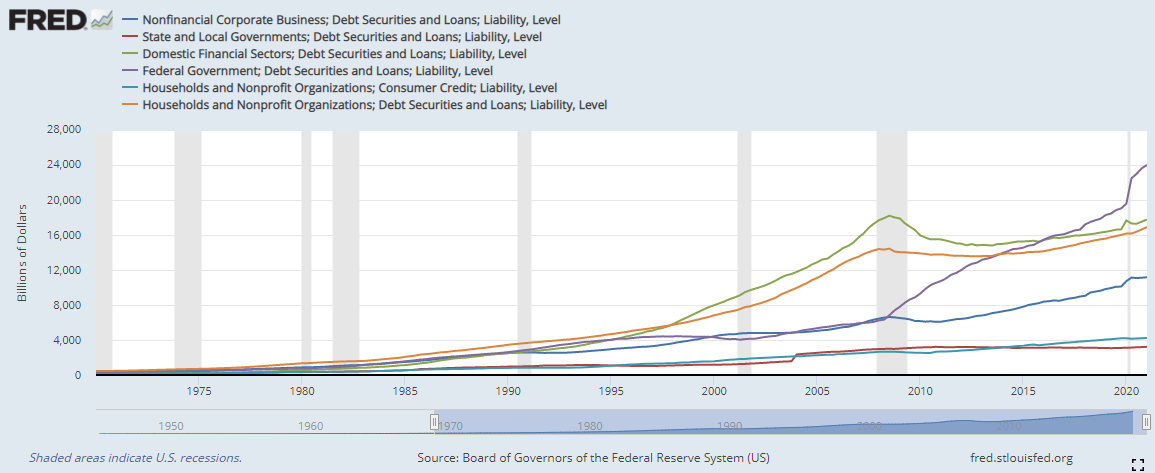

There are two things you will always see during a period of financialization: Explosion in debt and rising asset prices.

Debt

Debt is the hook of financialization. Like a drug, a little bit can be healthy and keep you balanced (think alcohol and weed). With 9:1 leverage, which isn’t hard to get using options or other derivatives, a 10% return on that investment doubles the amount you put in.

When times are good, scoring these types of returns leads to the desire for more. Greed drives you to repeat the process if it worked the first time. As long as the market is going up, everything is good. However, just as a 10% return can double your money, a 10% loss can wipe you out.

This is the power of debt. It can make you rich quickly, but it can also wipe you out just as quickly. The primary users of these types of strategies are the financial corporations but households and non-financial firms have also caught the leverage bug.

Can you guess the primary source of leverage for households? It’s by far the biggest source.

Mortgages!

The government-backed reduction in down payment requirements has resulted in the ability to put 3% down. That’s a 33:1 leverage on something that costs around $300k. A mere 3% return doubles your investment (the $9k down payment). It becomes obvious why house prices have shot up and the orange line in the chart below is one of the highest.

It sure looks like we’re all hooked!

Corporations love debt because:

- It can juice their return metrics

- It has tax benefits that paying dividends does not

- With the invention of loan securitization, borrowing restrictions have declined making it easier to leverage up

- It does not dilute the owners’ equity share of which the executives & owners of a firm are large holders

- They can hold onto larger cash balances should an economic shock hit

- It helps increase sales by offering it to customers who can’t afford to pay at the point of sale

- They can hide it by cooking the books via special purpose vehicles, joint ventures, and other off balance sheet accounting tricks

- Financial institutions love it because they have the legal authority to create money out of thin air, lend it out and collect interest. Literally free money. oh yeah, If the borrower defaults, they acquire the asset. What a genius scheme to eventually accumulate all assets!

Households love debt because:

- They can buy a big-ticket item they wouldn’t otherwise be able to afford to

- They can maintain their rainy-day savings in case of emergency

- It juices their returns too (can help build financial wealth if used properly)

- They can finance their living expenses without having to make difficult decisions

- They’ve become suckers to the gotta have it now society (consumerism & materialism)

Governments love debt because:

- They can spend without any limits (if your one of the G7 of course)

- It provides collateral to the financial institutions to keep the house of cards from crumbling

- They can control poor countries by coercing them into a loan that can never be repaid

- Once their citizens are in debt, they’re much easier to control and keep working

Asset values

Rising asset values (stocks, bonds, real estate etc.) are the line and the sinker. As the masses build their little nest eggs, nobody wants to see the value of their savings go down. Everyone wants to keep the charade going as long as possible. The financial interests of the masses become aligned with the interests of the financial firms, and you find at least a part of yourself supporting the financialization of the world.

And that’s not all. Higher asset prices lead to more debt because it now costs more to buy the assets. For example, if house prices go up, you must use more debt than before.

It’s a self-reinforcing cycle of debt leading to higher asset prices, higher asset prices leading to more debt, and it keeps going…. until it doesn’t.

Guess what happens when the music stops….

Your asset values drop like a rock while the cost of your debt remains the same, or even possibly goes up (in a deflationary crash).

This is the clever gotcha of financialization and something that I never hear anyone talk about…

Asset values rise and fall, and can go to zero (or be confiscated), but debts are (kinda) forever

In other words, once you have a large enough amount of debt, along with a comparable amount of assets, you’ve taken the bait hook, line, and sinker. Your assets can fall to zero or be taken to repay your debt, but your debt remains unless you declare bankruptcy, or it’s forgiven.

So, what can we do to reverse financialization?

The 3 Pillars of Wealth

There are a few changes that would put a dagger into the heart of financialization

- Sever the revolving door between government and industry

- Restore the separation of commercial and investment banking

- Outlaw lobbying and campaign contributions

Due to the extreme concentration of influence and power in world politics, these are the last things those in government and industry will agree to voluntarily. Such impactful changes must come from the bottom up.

Through clever advertising, easy access to debt and the declining purchasing power of our currencies, we’ve been bamboozled into a lifestyle that exploits the masses for the benefit of the elite. Let’s be honest though. Many of us are reluctant participants in this scheme because we don’t want to see the value of our assets fall.

If we ever want to get out of this mess, we must redefine our concept of wealth. A vast majority of people focus their energy on wealth, or even the appearance of wealth. The problem is the narrow definition of wealth has led us to a very difficult situation. From now on, we must think differently about wealth. We must expand it’s meaning to include joy we receive from all aspects of life, not just money and things.

To help change my view of wealth, I rely on the “3 pillars of wealth-being”. Each pillar reinforces a mindset that can reduce spending and debt, while promoting better overall health. Essentially, they redirect our focus from the “money and things as soon as possible” mindset, to happiness, health and long-term success that is associated with true wealth.

Investment

Investment is the basis for ALL wealth creation

Whether it’s investing in yourself for the purpose of finding what is meaningful to you, or so you can become more valuable in the job market, the fact of the matter is

Things won't get better until......YOU get better

Jim Rohn Tweet

First of all, higher income requires less debt, and as shown above, debt is the heart of financialization. Second, the pursuit of an intrinsic goal, such as building skills and knowledge, can reduce the urge to fill your wants by spending money. You are getting the pleasure and sense of worth from the fact that you are more valuable to yourself, your family, and your community. Not to mention, you’ll be focused on something other than all the stuff you’d like to buy.

Financial investment is the most direct way to fight financialization. Saving at least 20% of your income, thinking long-term and learning how to use debt sparingly and effectively, are all important steps to take if we are going to reverse the damage that has already been done.

Lastly, we all need to invest in our communities and our relationships. According to Harvard Medical school, “Dozens of studies have shown that people who have social support from family, friends, and their community are happier, have fewer health problems, and live longer.“6 I don’t know about you but I consider my happiness, health and a longer lifespan, an important part of my wealth.

A holistic approach to health

Strength and balance across the 10 components of holistic health is key.

This is a more indirect way of fighting financialization. The ideas of financialization, consumerism and materialism took over slowly through a change in our priorities and way of thinking. To be successful in reversing this cancerous way of living, we must address the lifestyle and mindset that has taken hold. Focus on health, which includes financial health, is an important part our attack.

There are health physical and mental health benefits of controlling the use of debt.10

There are also financial benefits from good health. Consider the fact that the average lifetime expenditure on health care is $316,600 in year 2000 chain-weighted dollars (is much higher in 2021 dollars)7. If we were to cut only $100,000 off that through the focus on health and wellbeing rather than material goods and money, we could save trillions of dollars (with a T!) over a generation.

This is a very important part of wealth-being because a longer life, more free time and the accumulation of skills and resources is useless if we are miserable or not physically able to enjoy them. The goal here is to thrive on multiple levels and to maximize the length and quality of our life.

Freeing up Time

In one sense, money can be viewed as a way to store and spend time. Saving money is a way to store time for future use, while borrowing money is a way to spend your future time right now.

By taking on debt, you are reducing the amount of your future time that you get to keep. This is why debt is commonly referred to as voluntary servitude. Essentially, you end up working for someone else to pay back the time you borrowed. The only way to avoid this is to use the debt productively.

This way of thinking equates your time with your pay rate or the rate at which you can generate money. It ignores the fact that time is invaluable and becomes infinitely more so as we get older (i.e., the less time we have on this earth).

Consider someone with 1 year left to live. If they had $1 million saved, most people would give that $1 million to have another 5 years instead of 1. What if they had $1 billion? Yup, they’d give that too. $1 trillion? Uh huh. Said differently, debt, and the waste of time in general, is much more expensive than it appears.

It seems to me that everyone under values their time at younger ages. Once we fully understand and accept the stupidity of our current mindset, we can take steps to change how we value our time and even free up more of it. Through the lens that time is part of our wealth, freeing up our time makes us more and more wealthy.

This is why I promote only the effective use of debt, putting standardized processes in place, automating where possible and focusing on what matters most as a pillar of my wealth-being. The wasting of time is possibly the single most expensive thing you can do.

Other actionable steps we can take are:

Financial education in K-12 schools

It’s a shame that a basic financial education is not provided in k-12 public schools. Some schools will offer economics but I’m talking about real life financial education such as how to budget, how compounding can either work for you or against you, how debt works and how to use it productively etc.

Most of the concepts can be taught as a part of the math curriculum. Instead of teaching math through applications in the natural sciences, why not teach math through the application to financial decisions? Nearly every single person on this planet will eventually have to make a financial decision. On the other hand, most people will not have to perform any calculations related to the natural sciences.

Imagine if high school graduates were able to apply cost benefit analysis to a few majors of their choice and the possible career paths related to each field! We’d probably end up with a population of much happier people. There would likely be a better balance between what they enjoy doing and their income, less debt (student loans) and a greater appreciation for long term planning and productive investment.

This is exactly the mindset we need to foster in our children to combat financialization, consumerism and materialism.

Unfortunately, it’s up to us parents and we should start with the very basics at an early age. For ideas and resources, please check out my Kids Money section.

Bank at credit unions and community banks

As I showed earlier, the large financial institutions are the primary players in the business of short term ponzi finance that leads to excessive debt, complex and risky products, stock options etc.

By directing our business to smaller firms, we’d redirect the flow of money into firms that utilize more conventional finance than the mega corporations do.

I know that smaller companies are generally more expensive to do business with than the mega corporations, but it seems to me that the long-term benefits are much closer to the costs than you’d think.

Become your own bank

No, I’m not talking about counterfeiting money like the banks are legally permitted to do. We’d go to prison for that.

I’m talking about peer-to-peer (P2P) lending. P2P lending is the borrowing and lending of money between an individual and other individuals or companies. It is usually done through an online platform which acts as a middleman in the transaction and collects fees from both parties.

It can be riskier than lending in mainstream markets so you should do your due diligence on all potential deals, just like you should for any investment. However, after seeing the shenanigans the credit rating agencies pulled leading up to the great financial crisis, it may not be as risky as it appears versus the mainstream markets.

There is also the option of lending between family and friends. This brings other types of risk into the picture, but you will be reducing the amount of fees collected by the banksters and the interest will stay within the family or community. This increases the financial wealth of the family relative to what it would have been had the loan been funded by someone outside the family.

P2P lending has two significant benefits, in terms of fighting financialization.

- No new money is created as long as the funder of the loan doesn’t borrow money from a financial institution. This reduces the devaluation of our currency common with mainstream lending.

Many studies show that the devaluation of our currency (i.e. inflation), leads to more financial inequality because the burden falls on the wealthy less than all others.8

- Keeping lendable funds within a P2P system will enrich the people to a much larger extent.

Debt Jubilee

Debt jubilees are not as radical as you’d think. As far as we know, the forgiveness of debt dates back to the Old Testament of the Bible. “Every seventh year you shall practice the remission of debts,” the 15th chapter of Deuteronomy reads. “This shall be the nature of the remission” every creditor shall remit the due that he claims from his fellow.”9

This would go a long way in fixing the weak economic growth we’re experiencing. However, I’m skeptical it would do anything to change the financialization mindset that has spread throughout our society. Without a change in mindset, we are destined to repeat the mess we’ve created.

The transition away from financialization will not be a quick process. It will take decades, if we ever actually do figure out how to pry our financial system back from the banksters. But we have to start somewhere, and, in my opinion, the best angle is to figure out a way to incentivize long-term, sustainable investment in financial education, time management and our health.

Get Our Latest Delivered To Your Inbox

You will receive 1-2 emails per month and you can unsubscribe at anytime