In the first two articles we covered the 5 ways to make money in residential real estate

& we answered the question about real estate as an effective inflation hedge. Our next question is “can residential real estate help diversify a stock portfolio?”

In order to evaluate the ability of residential real estate to effectively diversify your portfolio, I focus on 4 main things:

Summary

- Overall, residential real estate meets enough of the criteria to be considered an effective portfolio diversifier

- There are 4 main areas of focus when analyzing the diversification abilities of an investment:

- Correlations

- Annual residential real estate returns tends to be lightly correlated to the 3 main US stock indices.

- Correlations for some markets increase significantly over 5 & 10 year periods but still remain sufficiently low for a vast majority of markets

- Risk/Return

- At the national level, residential real estate can improve the risk/return profile of a stock portfolio due primarily to it’s significantly lower price variability.

- Most individual markets will also improve the risk/return profile but there are a handful who’s history of significant booms & busts offer a worse risk/return profile than the S&P500

- Performance during corrections, recessions & bear markets

- 75% of the time, residential real estate is up during stock market corrections since 1987

- Residential real estate does tend to fall during bear markets but not nearly as much as stocks

- Can you hold the asset outside the traditional financial system?

- Fail! – Residential real estate is a large, physical asset that you must tie to yourself to own it.

- It’s also difficult to discretely pass to your heirs

- Possible solutions is to hold the property in a corporation or other legal entity

- Correlations

Real Estate Correlations to Stocks

In fact, the highest historical correlation of a real estate market to the S&P500 is Detroit with a 0.45 correlation coefficient which is considered a light correlation. [1][2]

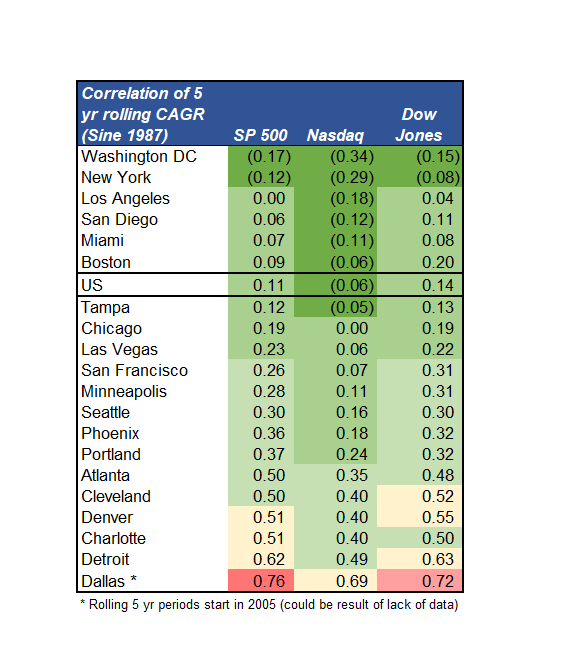

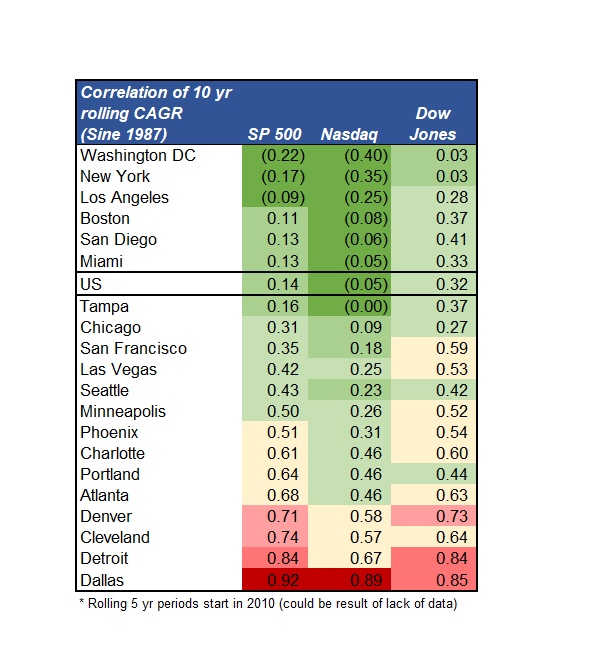

However, the real estate market moves much, much slower than the stock market so annual returns may not be the best timeframe to view correlations. Because of this I looked at the correlation of the 5-year & 10-year rolling returns & found pretty much the same thing but a bifurcation between markets started to appear.

Over 5-year periods, the correlations for most markets decreased & some even turned negative, while the likes of Atlanta, Cleveland, Denver, Detroit, Charlotte & Dallas increased. Even though the correlations increased over a 5-year period, they’re still fairly low. [1][2]

The problem is that the correlations for these 6 markets increased even further over a 10-year period to the point that is considered highly correlated. [1][2]

Two notes on these grids though.

First, I tend to ignore the extremely high correlations for Dallas because of the lack of data for the HPI.

Second, the correlations for some markets become quite high for the S&P500 & Dow but a lot of them are negatively correlated to the Nasdaq.

All in all, this shows that there are sufficiently low correlations between most real estate markets & stocks that it satisfies the objective of low correlation.

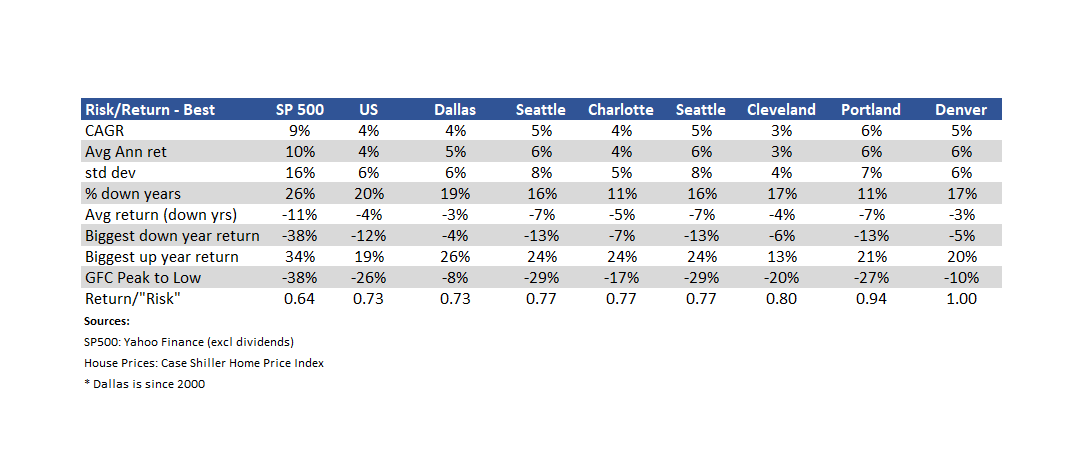

Real Estate Risk/Return vs Stocks

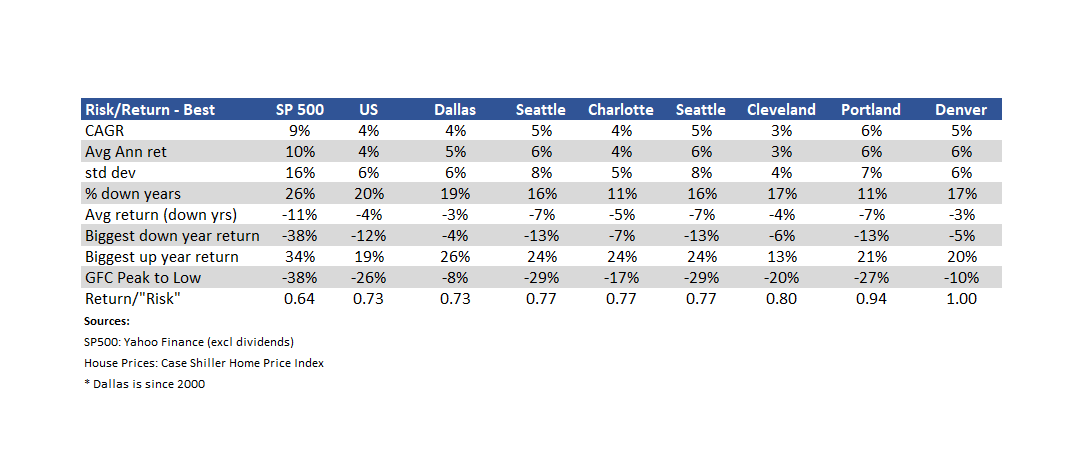

At the national level, it’s apparent that real estate will improve the risk/return profile of your portfolio.

Having said that, you’ll also notice that there again is a bifurcation between markets.

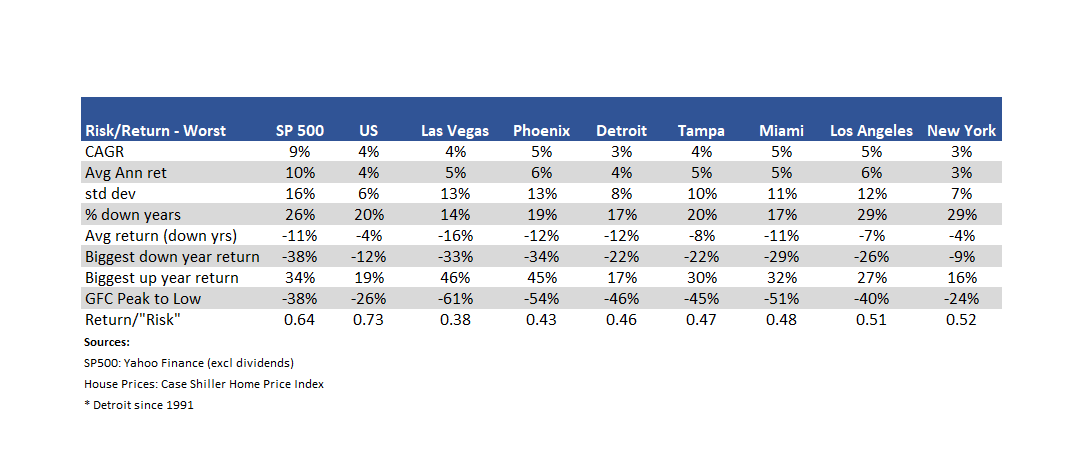

You have the worst performing markets, in terms of return per unit of “risk”, like Las Vegas, Phoenix, Detroit, Tampa & Miami. Their return/ “risk” is lower than the S&P500 & their peak to low drawdowns were significantly larger than stocks during the GFC.[1][2]

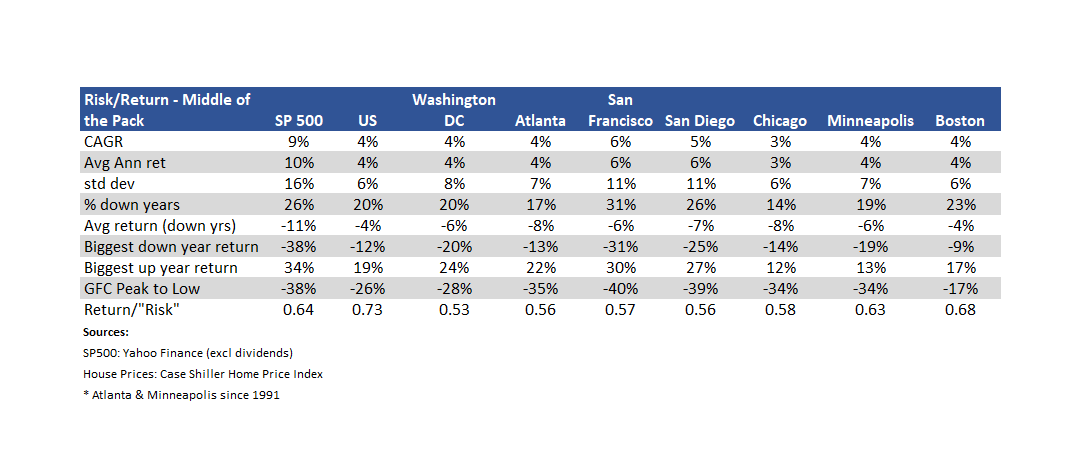

Next, we have the middle of the pack markets such as Atlanta, San Francisco, San Diego, Chicago & Minneapolis whose returns/ “risk” & peak to low drawdown during the GFC are about the same as the S&P500. Other than that, these markets are mixed with some having a higher % of down years, while most don’t, & most have lower avg returns during up years & lower avg returns during down years. [1][2]

I’d be careful here though. All these figures include the bubbly run up that we’re currently in & these metrics will change once the real estate market crashes at some point in the future.

Keep in mind, this only factors in price returns. It ignores cash flow, loan paydown & depreciation benefits. Once you factor those in, the total return will be a few % points higher than what is shown in these grids. As a result, I’d say that real estate satisfies the objective of not reducing the risk/return profile when added to a stock portfolio.

Based on the data we just reviewed, it is apparent that residential real estate, at the national level, provides strong enough returns, lower price variability, lower magnitude of drawdowns & low correlations that we can conclude it satisfies the objective of reducing the overall portfolio volatility without materially decreasing the expected returns.

The conclusion can change once you get into specific markets, but in general, most markets will also satisfy this objective.

The next consideration of an assets ability to diversify a portfolio is

How Does Real Estate Perform During Recessions, Corrections & Bear Markets?

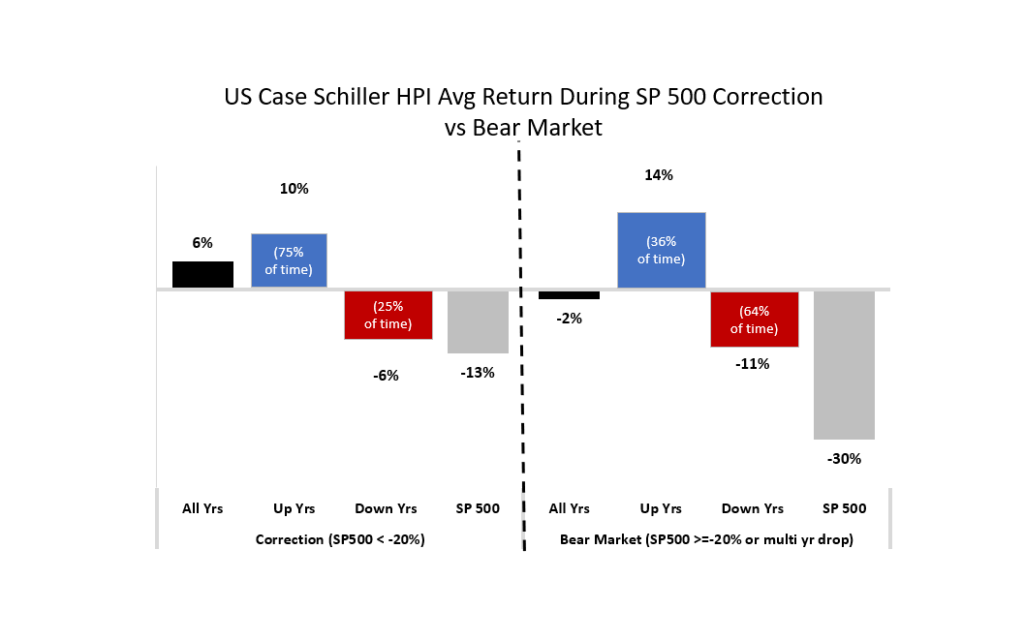

I went back & looked at the behavior of residential real estate on a national level during stock market corrections & full-on bear markets since 1890.

I define a correction to be a drop in stocks of 10-20%, While I define a bear market as a drop in stocks of 20% or more, or a multi-year pullback.

As you can see in this chart, real estate holds up very well during both corrections & bear markets. [1][2]

During corrections, real estate increases 6% on average & has dropped an average of 6% only 25% of the time. In other words, when stocks drop 10-20%, real estate is up 75% of the time. [1][2]

During bear markets, real estate does tend to drop but not nearly as much as stocks. On average, real estate falls a measly 2% while stocks drop 30%. While there have been times where real estate rises during a stock bear market, most of the time it will fall as well. The good news is that when real estate does drop during stock bear markets, it drops on avg 11% versus a 30% fall in stock prices. [1][2]

The combination of low historical correlations with the fact that it tends to hold up pretty well during stock market corrections & bear markets, leads me to conclude that real estate indeed acts as a diversifier in a portfolio.

Another fact that supports this conclusion is that out of 19 times that stocks dropped 10% or more, real estate NEVER dropped more than stocks. [1][2]

Having said that, there have been several instances of real estate dropping while stocks have increased – Again, pointing to the low & sometimes inverse correlation between stocks & real estate since 1890.

Location Location Location!

Don’t forget the risk/return tables we just covered.

The chart above looks at real estate on a national level. As I’m sure you’re aware, real estate is very location specific. While real estate holds up well during corrections & bear markets on a national level, markets such as Las Vegas, Phoenix, Tampa & Miami dropped 61%, 54%, 45% & 51% respectively during the GFC[1]

Not the bastion of protection that the chart above shows.

Another increasingly important, yet often overlooked, aspect of diversification is the ease in which you can hold an asset outside of the traditional financial system.

Can You Hold Real Estate Outside the Traditional financial system?

As censorship of opinions that differ from the official narrative increases, & the state increasingly targets its own citizens [3] [4], It is becoming more & more important that we hold assets that can’t be traced back to us or are highly resistant to seizure.

Unfortunately, real estate fails miserably in this area. Being such a large physical asset & having to tie the property to yourself for the purpose of establishing ownership, it exposes you to the possibility that a claim or judgement by the state be placed on the property.

Solutions!

For the same reason, it can be difficult to pass real estate onto your heirs in a discrete way so that they don’t have to pay taxes.

One potential solution is to hold a property in a corporation or legal entity such as an LLC. Not only can this help protect your other personal assets from a claim or judgement, it can also be a way to avoid taxes &/or penalties when passing assets to your heirs.

DISCLAIMER: I am just a dude on the internet offering ideas, information & education. ALWAYS consult a qualified legal professional when dealing with taxes & estate planning.

That concludes this discussion on the ability of residential real estate to diversify a stock portfolio. Based on the evidence, it satisfies this objective at the national level & for most individual markets.

The final discussion around the benefits of residential real estate is it’s intrinsic value, which will be the topic of our 4th part of this 6 part series on investing in residential real estate.

[1] S&P/Case-Shiller National Home Price Index. https://fred.stlouisfed.org/series/CSUSHPINSA#0 Accessed 8/26/2022

[2] Yahoo Finance. https://finance.yahoo.com/quote/%5EGSPC/history?p=%5EGSPC Accessed 8/26/2022

[3] New York Post. “DHS warns against mistrust of US government in latest terror bulletin.” https://nypost.com/2022/02/09/homeland-security-labels-conspiracy-theories-a-terror-threat/ Accessed 8/26/2022

[4] Center for Security Policy. “The Department of Homeland Security is telling you what is misinformation – Why you should be concerned.” https://centerforsecuritypolicy.org/the-department-of-homeland-security-is-telling-you-what-is-misinformation-why-you-should-be-concerned/ accessed 8/26/2022

Get Our Latest Delivered To Your Inbox

You will receive 1-2 emails per month and you can unsubscribe at anytime