If you ever step your virtual foot into Fintwit (Twitter’s #PersonalFinance world), you’ll be bombarded with an echo of the slogan “Index it & forget it.” The vast majority of participants think everyone should invest in index funds, take the market return, & go on with their lives.

I agree to an extent. Buy a low-cost index fund & let time do all the work. It doesn’t matter if it’s because you don’t have the time, desire, or the financial knowledge to pick individual investments. Study after study shows passive funds outperform their active counterparts over long periods of time.

But return is only one part of the equation when it comes to investing. Risk management is the other part.

Passive investing comes with many risks unknown to most index investors. Every investor should understand these risks because most of them are systemic problems that will affect every investor. It doesn’t matter if you’re holding index funds or not.

In this article we will briefly review the benefits of index funds but spend most of the time digging into the hidden risks & market distortions that passive investing creates.

Key Points

- Index Funds are the Best Investments for Many Investors That Don’t Have the Time, Knowledge, or Desire to Manage Their Own Portfolios

- The Pros of Passive Investing

- Simplicity

- Low Cost

- Superior Long-Term Risk Adjusted Returns

- Fewer Taxable Events

- The Cons of Passive Investing

- Impaired Price Discovery

- Concentration in the Asset Mgmt. Market

- Company Concentration Within the Indices

- Increasing Correlation Between Stocks

- Credit Ratings Are Lower Than You Think

- Manipulation of P/E Ratios

- Synthetic ETFs

- Securities Lending

- You’re Participating in Momentum Investing

The Pros of Index Funds

Over the past 30 years, the public has been beaten over the head with arguments in favor of passive investing. Index funds are for you If you’re looking for investments that are:

Simple

There isn’t much to do other than buy the shares of a fund that tracks the index that you want to invest in.

There is an index fund for pretty much every index out there, including some proprietary indexes. Want to invest in the largest US stocks? You have thousands of S&P 500 index funds to choose from. Want to invest in mid cap, small cap, or technology stocks? There are thousands of index funds for those too. You can even go broader with total world stock or bond funds, or more specialized with gold, real estate, high yield bonds or emerging market index funds.

Low Cost

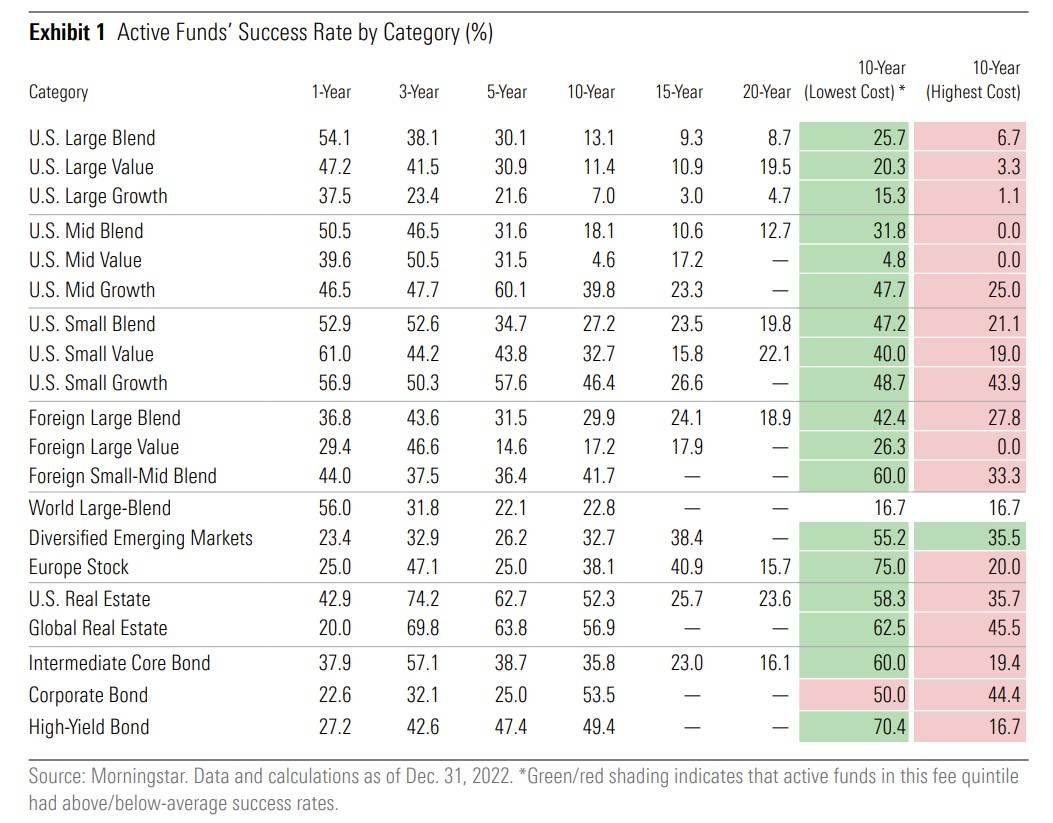

The average active fund charges approximately 8 times the fees that passive funds do (.63% for active vs .08% for passive as of 2021)[1]. According to Morningstar research, Fees are one of the best predictors of future fund performance. [2]

Many active managers can beat their index but not by much, & not over long periods of time. The problem is that active management requires higher back-office costs like more analysts, specialized software, travel etc. These costs are passed on to the investor which lowers your returns.

Offer Superior Long-Term Risk Adjusted Returns

It’s not uncommon for active funds to outperform passive in a given 1 or 3-year period. But as you get into the 5-year period, active management falls behind in nearly all categories. It only gets worse as you move out to 10, 15 & 20-year time frames.

Over 20-year periods the % of active funds that beat their passive counterparts tops out at 23.6%. In other words, even in the category where active funds did the best versus passive funds, active funds underperformed passive 76.4% of the time.[2]

Trigger Fewer Taxable Events

Since the investments within an index do not change frequently, the investments that track the index do not change much either. This generally means less taxable events within index funds versus active ones.

The one exception is when there is a change to the index. In this case, the funds are required to sell/buy any investment that was removed/added from/to the index, regardless of price.

If these are the qualities of an investment that you’re looking for, then there is nothing wrong with investing in index funds.

However, a prudent investor seeks to understand the full picture of an investment because what you don’t know CAN HURT YOU.

The Cons of Index Funds

There are many things that I’ve learned about life in my 40 years and one of them is that nothing is perfect. For all the good/benefits that any given “thing” offers, there are ALWAYS tradeoffs, limits, or unintended consequences that come with the benefits.

My favorite analogy is with electric vehicles (EV’s). People have been sold the idea that if we just electrify our cars that we can help save the world. If your sole objective is to decrease the use of fossil fuels, then the idea appears to be a good one. But once you dig beneath the surface you realize that there are tons of other factors to consider. The batteries require a significant amount of earth metals which must be mined. This destroys the environment, just like fossil fuels. The mining process creates toxic by products that find their way into our water sources. Then there is the fact that, depending on where you live, most of your electricity may be coal generated. Once you get a view of the entire landscape, it becomes apparent that EV’s may offer marginal benefits, if any.

The same thing goes for index funds. There are the several benefits that I outlined above. But there are plenty of drawbacks as well. That is what we’re going to cover in this section.

Fees are Not the Same as Costs

Earlier in this article, we mentioned the lower fees associated with index funds as one of its benefits. But fees are not the same as costs. The cost of passive investing is much higher than the expense ratio that you pay to invest in an index fund.

Just like in our EV analogy, there are several downstream & unintended effects from index investing. They increase the true cost of investing for all market participants, whether they invest in index funds or not.

Impaired Price Discovery

In a free market economy, prices are the most important variable there is. It’s the primary mechanism by which resources (i.e., money looking for an investment) are allocated. Index investing outright ignores it.

For example, say an investor puts $1,000 in the Vanguard S&P 500 ETF (VOO). Vanguard is required to allocate that $1,000 based on the weighting of companies within the index at that moment. Nobody looks at Chubb Limited (CB) & determines that $200/share is a smart investment.

As the purchaser of VOO, you’re investing $2.60 (0.26% weighting) of your $1,000 in CB regardless of whether it’s trading at 10 times earnings or 1,000 times earnings. You are a price taker. There is no price discovery in the process. It’s like you bought 504 pairs of shoes, regardless of their price, just so you can own the ones you really want. Would you do that? I didn’t think so. But this is what you are doing when you purchase an index fund.

What Do You Think Happens To The Price of CB?

Yeah, it’s higher than it otherwise would be when millions of people buy the stock just because they invested in $VOO!

This brings me to the next cost of passive investing.

Concentration in the Asset Management Market

- The concentration of fund-based assets under management (AUM) over the past couple decades has been staggering. BlackRock, Vanguard & State Street receive approx. 80% of capital allocated to investment funds today. Even more troubling is the fact that they are the largest shareholder in 88% of S&P 500 companies & 40% of all US listed companies [3]. Additionally, they’re expected to eventually control over 40% of voting shares in the S&P 500.

- Ask yourself, do you think that these asset managers vote for initiatives that increase competition? This article from the Harvard Business Review outlines why they have the incentive to use the corporate governance framework (aka voting shares of stock) to reduce competition, keep output from expanding too much & ensure that the prices of goods & services don’t fall.[4]

“The common owners of rival firms [The BlackRocks, Vanguards & State Streets] do not benefit when the firms compete by cutting prices or expanding output. In fact, they may even “soften competition” among firms in their investment portfolio. To begin with there is the potential of active efforts to stymie competition, such as encouraging the signing of anti-competitive agreements or passing sensitive information between two commonly-owned competitors…….

More worrying is the unintentional collusion through the owners’ corporate governance communications, the information flows between the firms and owners, and the incentives to lessen competition that common ownership brings, without any coordination or communications among the ostensibly competing firms.

Let’s look at the interplay between the shareholders of large corporations and the managers that actually run them. Managers need shareholders to vote for their corporate initiatives and their re-election. To accomplish either, smart managers will maximize the weighted average of their shareholders’ profits from across their diverse portfolio of stockholdings. This way they will gain the votes of shareholders’ whose profits they boost by increasing the value of both the manager’s firm and the other companies held by that shareholder. It would be “remarkable” if firm managers did not pay attention to the profit interests of their leading shareholders given the various sources of corporate accountability such as executive compensation incentives, takeovers, control contests, labor markets, and direct communications.

Horizontal shareholding therefore hurts competition because, as Einer Elhauge of Harvard Law School has argued, it reduces “each individual firm’s incentives to cut prices or expand output by increasing the costs [to shareholders, and thus managers] of taking away sales from rivals.” ……….

……. [Additionally], it is near-costless for index funds to influence a firm to behave anti-competitively through voting on general corporate governance matters that apply to all corporations in their portfolio. Moreover, proxy advisory firms lessen the effort that index funds need to exert by providing them with company research and vote administration services, and even guiding their voting.

……. the shareholder voting rights of all funds within the institutional investor fund family are usually exercised jointly. The “rise and consolidation of intermediated asset management” increases the shareholder power of large diversified owners and reduces portfolio firms’ competitive incentives.”[4]

In summary, investors may benefit from lower expense ratios, but they pay for it in terms of higher prices of real goods & services in addition to higher prices of stocks due to the destruction of price discovery.

The Extent of Diversification is a Mirage

Proponents of index funds argue that you get instant diversification by investing in just one fund such as VOO. With an S&P 500 index fund you hold 504 different companies so you must be well diversified right?

To some extent sure. But not to the degree that those selling you the investment would like you to believe.

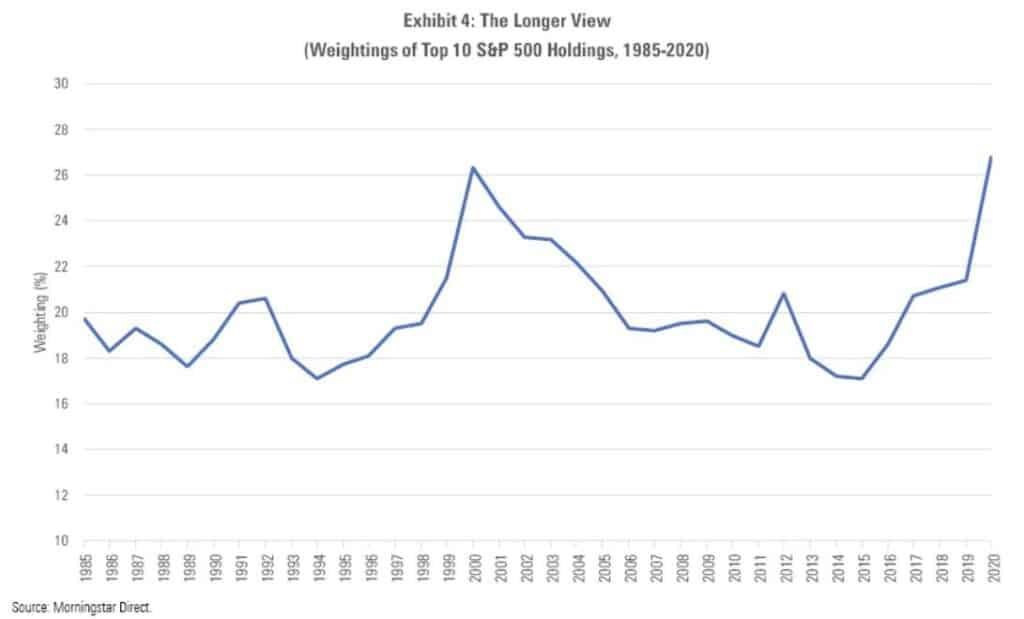

Company Concentration Within the Indices

Not only is there concentration at the asset manager level, but there is also concentration within the indices themselves (at the company level).

Currently, the top 10 companies in the S&P 500 (2% of the 504 companies) account for 27% of the weighting. The top 5 companies (1%) account for 19% of the weighting.

The last time we saw this level of concentration was right before the Dotcom bubble burst in 2000.

Even worse, the breadth of the current market is horrible. The S&P 500 is up ~10% YTD but the top 8 stocks, in terms of weight (1.6% of the 504 stocks), account for the entire return of the index this year. The other 98.4% combine to be flat for the year. How insane is that!

Now, having a large portion of your money in the best companies in the world is not necessarily a bad thing. In fact, I prefer to find high quality individual companies that have demonstrated superior business management over long periods of time, & to invest in only them. Why would I want to hold hundreds of companies that either do not exhibit the same type of business management, stewardship of investor capital, or economics? I don’t.

The difference is that I know I’m concentrated in a few companies that can have big impacts on my portfolio. With this understanding I can put risk management processes in place to guard against large losses from any single holding. This isn’t the case with index funds which are passively run. They are buy & hold strategies. They offer no risk management other than the fact that you hold 504 different stocks. As I will demonstrate below, they do not offer the level of diversification that people think they do.

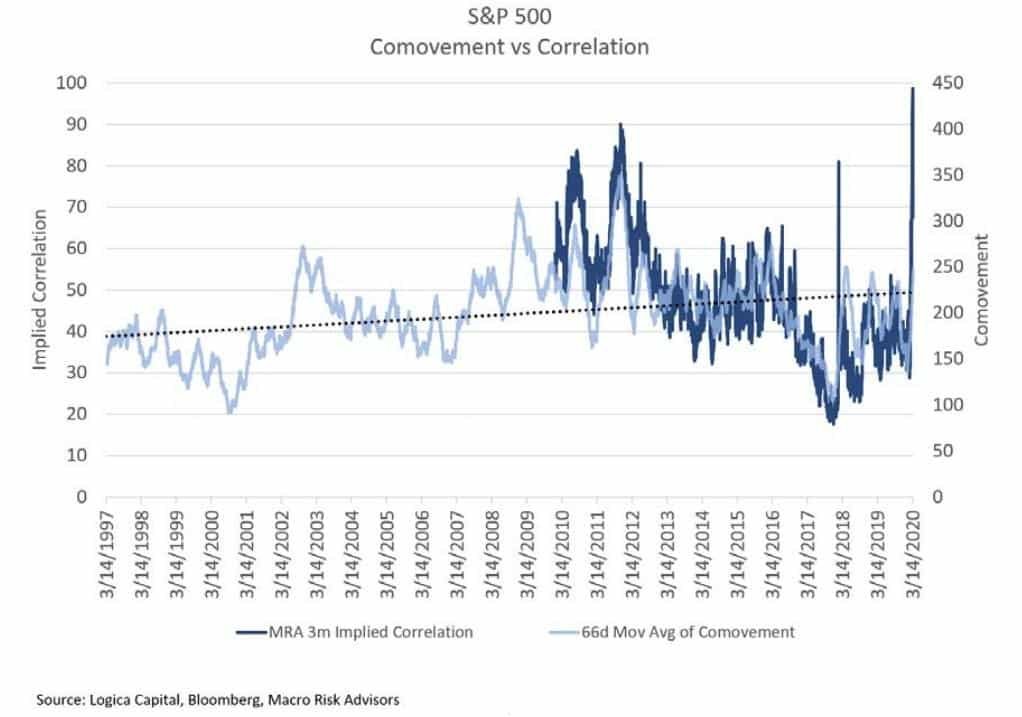

Increasing Correlation Between Stocks Reduces Diversification

The main purpose of diversification is to increase risk adjusted returns by reducing volatility & stabilizing returns. For this to be true, there must be a meaningful lack of correlation between assets. S&P 500 index funds do not offer this.

For example, Let’s say you hold one stock. If it goes down 10% in a year, your portfolio goes down 10%. Now let’s say that you add a dozen stocks to your portfolio, all of which have high correlations to each other. If the market falls by 10%, they’re all going to fall around the same 10% & so will your portfolio. You have done nothing to protect against the drop in the market. Just adding companies does not make you more diversified. You have to hold assets that generally behave differently than each other, especially during downturns.

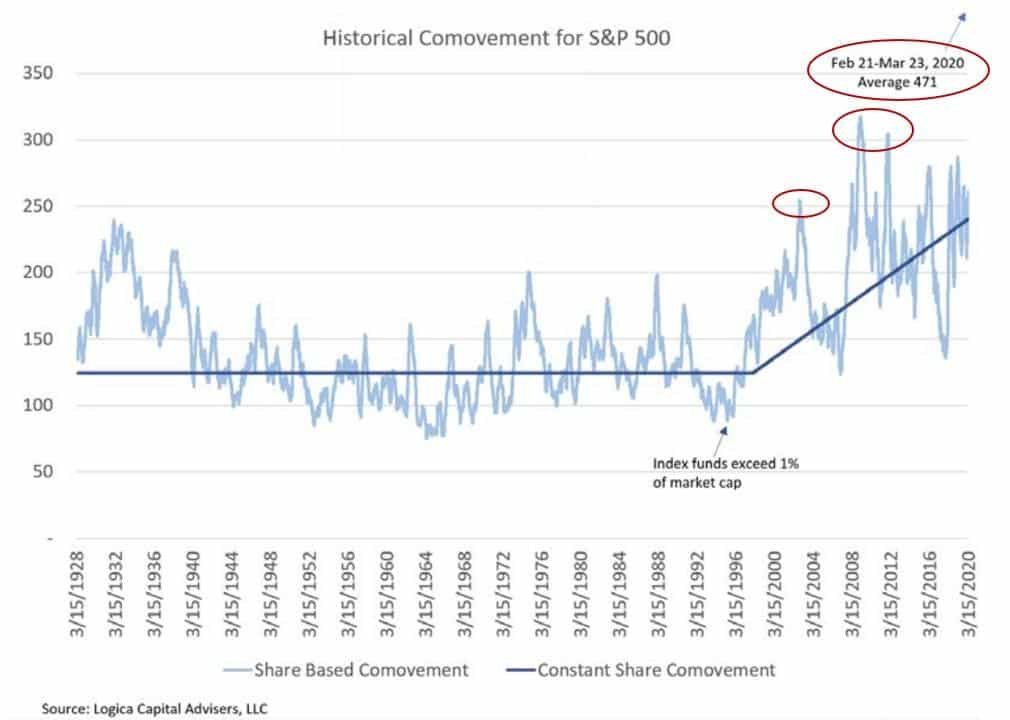

The problem is that companies within the S&P 500 index exhibit significant co-movement. Co-movement is the term for the number of stocks that rise or fall on a given day. If half the stocks rise & half fall, then the measure would have a value around 0.

Why Co-Movement & not Correlation?

You can find an explanation as to why we’re focusing on co-movement rather than correlation here. But as you can see in the chart below, co-movement & correlation are practically synonymous.

So, what has happened to the co-movement of stocks within the S&P 500 over the past 100 years? I’m glad you asked.

From 1940 to 1996, co-movement stayed in a tight range. Starting around 1996, the co-movement (implied correlation) of stocks in the S&P 500 has shot up significantly. It has continuously risen since.

Even worse, co-movement spikes during times of market distress. As you can see in the chart above, it spiked during the Dotcom bust, it spiked again during the Great Financial Crisis (GFC), & it went to the moon during the Covid crash.

In other words, the exact times that you need diversification to do what it’s supposed to do, the companies in the S&P 500 index do the exact opposite.

Another thing to note in the chart is that co-movement is getting worse & worse during market crashes. It’s to the point that there has been practically no benefit to diversifying your portfolio by owning the S&P 500 alone. They fall together as if they were a single stock during market crashes & more than half of them move in the same direction on any given day.[5]

You're Not Buying What You Think You're Buying

When ordinary people invest their hard-earned money in a S&P 500 index fund, they, along with most investment professionals, think “hey, I’m buying the 500 largest companies trading in the US stock markets. They’re in this group because they’re good companies so there isn’t much risk.”

Sure, the top stocks like Apple, Microsoft, Berkshire etc. are safer investments. But most investors would be surprised at the sheer count of companies that are rated low investment grade or worse by S&P.

S&P 500 Credit Ratings Are Lower Than You Think

Prudent investors want to make sure that the companies they’re buying are worth their trust. Unfortunately, many are not. As of the end of 2021, there were 138 of the 504 companies (26%) that were rated medium investment grade or higher by S&P.[6]

This means that an astonishing 74% of S&P 500 companies were rated low investment grade or worse. I include low investment grade here because this is the last bucket that is considered investment grade. One downgrade could push them into junk status.

In fact, downgrades are not uncommon. According to Investor’s Business Daily, many well-known S&P 500 firms (37 to be exact) including Las Vegas Sands, Marriot, Coors, & Kohl’s were on the brink of junk status as of April 2020.[7]

Most investors who own S&P 500 index funds would probably be surprised by this. They’d probably think that the split is reversed (73% mid investment grade or higher).

My Question To You

Is it smart to buy companies that are barely investment grade or even junk rated as long as you own 138 other stocks?

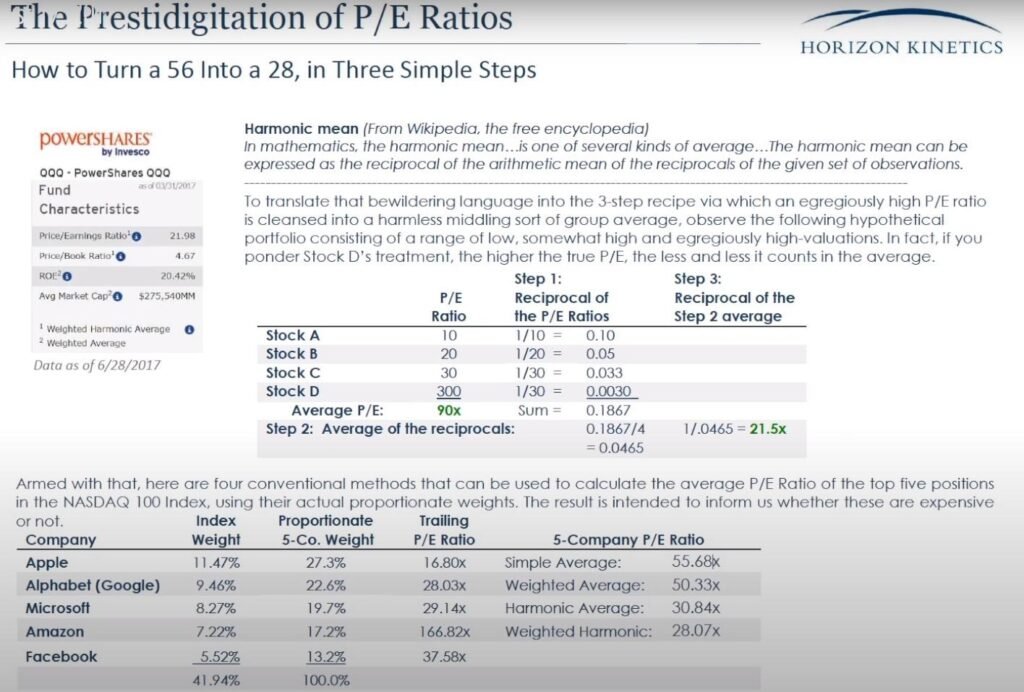

Manipulated PE Ratios

As I demonstrate below, funds can use several strategies to show a much lower PE ratio than what the underlying investments offer. To name a few, they can

- Use a weighted harmonic average.

- Exclude unprofitable companies (PE ratio is N/A or negative)

- Drop companies with extremely high PE ratios (because they’re “outliers”)

Here is how the Nasdaq 100 index fund (QQQ) halves the PE ratio of the underlying investments.

You’re Participating in Momentum Investing

With a market cap weighted index like the S&P 500, each company’s market cap determines the proportion of your money that goes into each company. There are two variables that go into the calculation of market cap. Price & the number of shares outstanding.

# of Shares Outstanding

Holding all else equal, if the number of shares outstanding increases, then so will the market cap. In other words, you are buying more of a company as your stake is being diluted by the company.

For example, Let’s say company xyz has 100 shares outstanding on day 1. You buy the stock of a company for $1/share, so you own 1% of the company. Say they double the number of shares outstanding. The next $1 only buys you 0.5% of the company. If they double the shares outstanding again, your $1 only buys 0.33% of the company. Would you continue to buy these shares? You’re getting less & less of the company even though the price of the shares didn’t change.

Now reality is much more complicated than this. My point is that with index funds you could be getting less & less for your money just because a company is increasing their shares outstanding. This is called dilution & it’s one way that companies steal from equity investors to help finance the company.

Price

The other variable is price. Holding all else equal, the weighting of a company increases just because the price increases. This means you’re buying more & more of a company as its price increases. This is called momentum investing. It’s not the same as the prudent investing strategy people think they’re participating in when they buy an S&P 500 index fund.

If you’re not aware, momentum investing is a buy high, sell higher strategy that can easily blow up in your face. There isn’t anything wrong with momentum investing per se. Tons of people (primarily traders) use it successfully every day. It’s just not what an investor thinks they’re doing when they buy an S&P 500 index fund.

These last two are a shocker to me. When you hear that a fund is passively managed or that their goal is to track an index, you think that they set it & forget it. But no, that would make too much sense. In all fairness, these practices are confined to a small percentage of index funds out there. Nevertheless, index investors should be aware of them.

Synthetic ETFs

There are many ETF’s out there that are referred to as synthetic. This means that they do NOT invest in the underlying securities that they claim to represent.

Instead, they use derivatives to indirectly invest in the underlying securities. Unless you are aware that these funds exist, you may be buying a bag of derivatives disguised as a normal ETF.

Of course, any fund that partakes in such activities must legally notify investors in their prospectus & other marketing materials. So, make sure you read their materials carefully & due your due diligence.

Securities Lending

ETFs can also lend the underlying investments to hedge funds, broker dealers etc. in exchange for a fee. It doesn’t take a genius to realize that this introduces counterparty risk to the ETF which an investor may not be aware of.

The ETF typically requires collateral to back the loan, but some may not. The collateral can be anything from treasuries to asset backed securities all the way down to derivatives.

According to Morningstar, the collateralization required usually falls in the 102% to 105% range[8] . This overcollateralization sounds good until you realize two things.

- At 105%, a measly 4.71% drop in value of the collateral results in a loss to the ETF & therefore its investors. At 102%, only a 1.98% drop is required.

2. There is the possibility that the borrower goes bankrupt.

Morningstar also states that the “strategy risk always overshadows securities lending returns”, and “High securities lending returns are eye-catching, but no amount of lending revenue will offset risk inherent to the underlying strategy.” [8]

Of course, any fund that partakes in such activities must legally notify investors in their prospectus & other marketing materials. So, make sure you read their materials carefully & due your due diligence.

As I mentioned in the beginning, this article is not intended to dissuade you from investing in index funds. Particularly S&P 500 index funds. In fact, I hold a significant amount of my financial wealth in such funds. But if you want to be a prudent investor that adheres to the timeless principles of investing, then it’s important that you understand the risks you’re taking with your money because it can easily be lost.

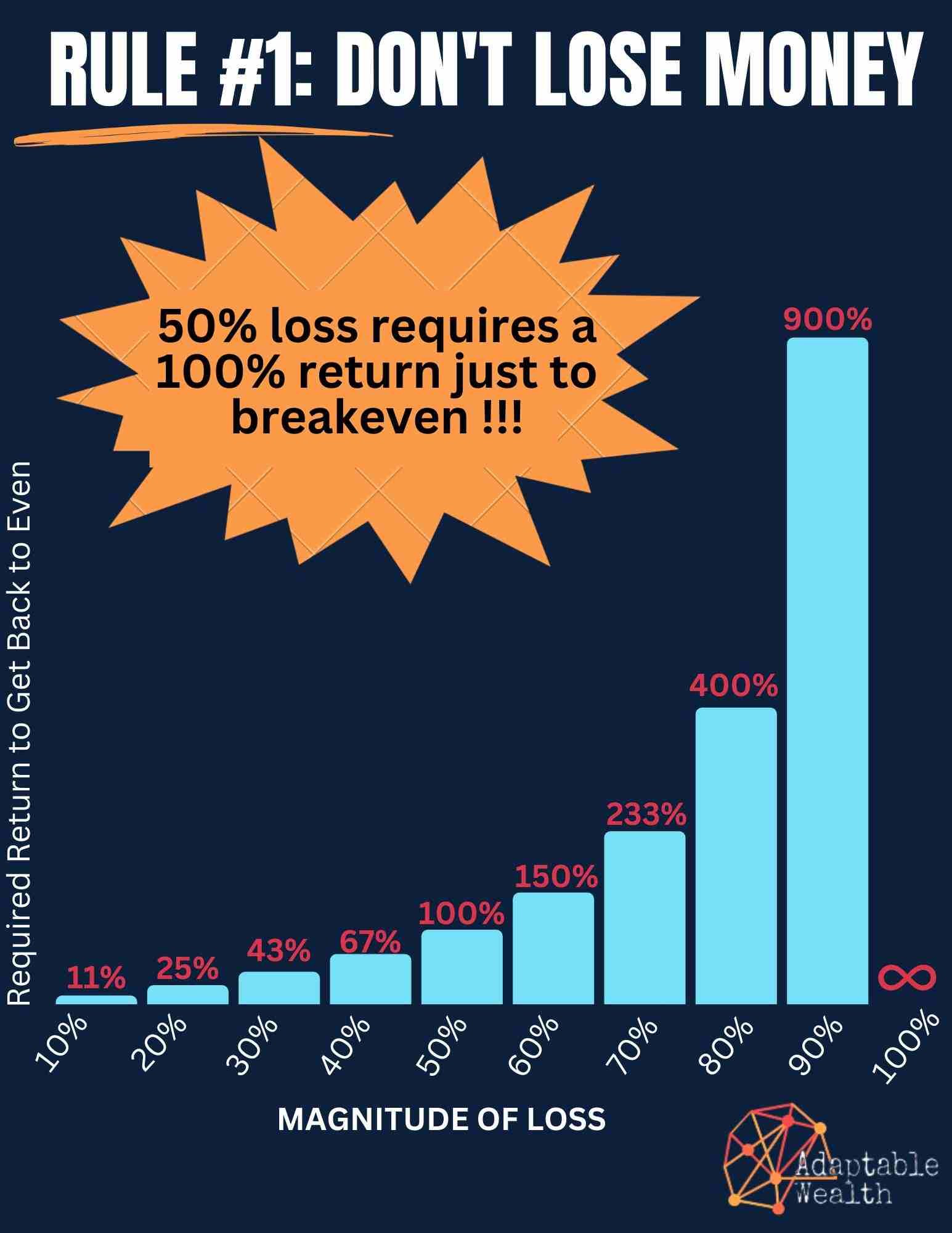

One of those timeless principles is Warren Buffet’s rule #1: Don’t lose money

To achieve this, you must practice sound risk management.

One of the things that irks me the most about investing advice on Fintwit & other platforms is the idea that

- If you’re not 100% invested in stocks

- If you ever sell & hold some cash

- If you don’t mindlessly buy regardless of what the market is doing (they call this dollar cost averaging)

then you’re trying to time the market. It appears that prudent risk management has flown right out the window over the past 20 years.

I’m here to tell you that it hasn’t. The same timeless principles of spreading your money around in various assets still applies. You should own some stocks & bonds. You should own some real estate, & gold, & silver. And once you build a good foundation, you should consider bitcoin, farmland & other alternative assets.

This is how real diversification is practiced. You need separate assets classes. Holding different types of stocks offers little to no protection on the downside because they all tend to move together, especially during a crash.

As I close this article out, I’d like to offer you two investments that diversify your wealth more than any others. Investing in yourself (skills) & your health. Investments in these areas will not lose value no matter what happens in financial markets.

[1] “Fund Fees’ Continued Decline is a Win for Investors”. By Bryan Armour. https://www.morningstar.com/articles/1055229/fund-fees-continued-decline-is-a-win-for-investors . Accessed 5/31/2023

[2] “Morningstar’s U.S. Active/Passive Barometer Year-End 2022”. By Bryan Armour, Ryan Jackson & Dimitar Boyadzhiev. https://assets.contentstack.io/v3/assets/blt4eb669caa7dc65b2/bltf38c1fd138e35c1e/63fcddc6fac83410ca2abf54/APB_US_2022_Year-End.pdf. Accessed 5/31/2023

[3] “Hidden Power of the Big Three? Passive index funds, re-concentration of corporate ownership, and new financial risk”. By Jan Fichtner, Eelke M. Heenskerk & Javier Garcia-Bernardo. https://www.cambridge.org/core/journals/business-and-politics/article/hidden-power-of-the-big-three-passive-index-funds-reconcentration-of-corporate-ownership-and-new-financial-risk/30AD689509AAD62F5B677E916C28C4B6. Accessed 5/31/2023

[4] “How Big a Problem Is It That a Few Shareholders Own Stock in So Many Competing Companies?” By Jacob Greenspon. https://hbr.org/2019/02/how-big-a-problem-is-it-that-a-few-shareholders-own-stock-in-so-many-competing-companies . Accessed 5/31/2023

[5] “Policy in a World of Pandemics, social Media and Passive Investing.” Logica Capital Advisors. https://web.archive.org/web/20210227173601/https://ffbc840d-1f33-4cac-a99e-a69e0ab835c1.filesusr.com/ugd/64c439_8e817dad179440ad900126f0514075ea.pdf . Accessed 5/31/2023

[6] “List of Top S&P 500 Corporations by Credit Rating – November 2021.” By Folio Nerd’s Blog. https://seekingalpha.com/instablog/54173270-folionerd/5663068-list-of-top-s-and-p-500-corporations-credit-rating-november-2021 . Accessed 5/31/2023

[7] “These 37 Companies Teeter On The Verge of ‘Junk’. “ by Matt Krantz. https://www.investors.com/etfs-and-funds/sectors/sp500-teeter-companies-dangerously-close-becoming-junk/ . Accessed 5/31/2023

[8] “Understanding Securities Lending in ETFs.” By Zachary Evens. https://www.morningstar.com/etfs/understanding-securities-lending-etfs . Accessed 5/31/2023

Get Our Latest Delivered To Your Inbox

You will receive 1-2 emails per month and you can unsubscribe at anytime