This is the 5th in a series of 6 which covers pretty much everything you need to know about residential real estate investing. So far, we’ve covered all the benefits such as the 5 ways you can make money, how it’s an effective inflation hedge & portfolio diversifier, & it’s enormous amount of true intrinsic value. But any rational investor realizes they must consider the risks along with the benefits. You’d be a fool not to

Summary

- Investing in real estate, as opposed to buying a house to live in, comes with many risks not commonly discussed

- The #1 risk to an investment in real estate is the current real estate bubble

- The shear level of inflation adjusted house prices are significantly out of whack with historical trends

- House prices have deviated significantly from incomes

- Mortgage payments as a % of median household income are the highest in 32 years

- Prices have deviated significantly from rents

- FOMO

- High sales to list ratio

- Low % of price drops

- Insanely low Days on market

- High % pending within 2 weeks

- Unsually low supply

- Current homes for sale are at all-time low but new construction has gone vertical

- Investor Market share is unusually high

- Underwriting

- Underwriting is much much better than leading up to the GFC but how have the moratoriums on evictions, foreclosures, student loan payments & much more contributed to this?

- Other risks include:

- Poor liquidity

- Location Risk

- Bad Tenants

- Vacancies

- Wear, Tear & Repairs

- Legal Risks

- Asset Seizure

- Negative Cash Flow

- Default/Foreclosure

- Scams & Freud

- Large Upfront Costs

- Poor Due Diligence

- The #1 risk to an investment in real estate is the current real estate bubble

The overwhelming risk to an investment in real estate right now is

The Bubble in the Housing Market

In my opinion, we’re in another housing bubble. The evidence is overwhelming.

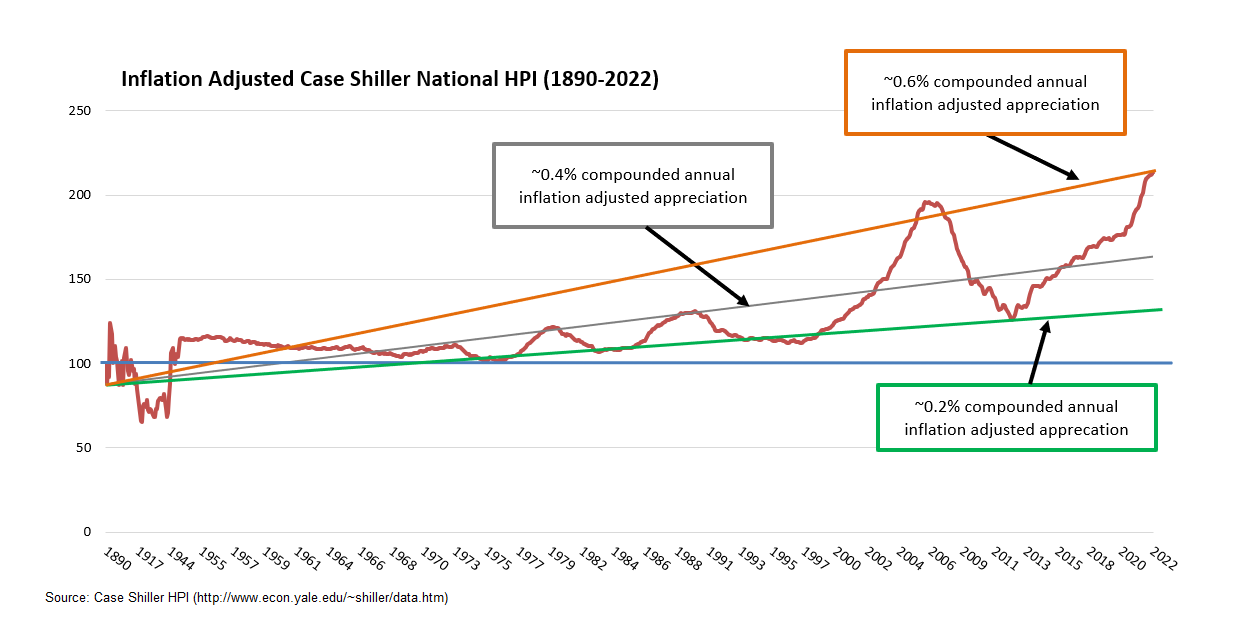

Look at this chart from Case Shiller that we discussed earlier.

It shows the real (inflation adjusted) home prices at the national level. We’re currently at an index level of 213 versus an index level of 196 at the peak in 2005-2006 right before the bursting of that bubble.[1]

The overwhelming consensus of the cause of the current bubble is lower interest rates & extremely low supply.

I’m not here to make an argument about whether the housing bubble is going to pop now or at some point in the future. It’s quite easy to see that we will eventually come back to the green line. We always do & we will again at some point.

Since 1968, the housing market has retraced to this green trend line 5 times! & it will once again at some point.

Instead, I wanted to focus on establishing the fact that we are in a housing bubble once again, & that this remains the primary risk to a real estate investment at this point in time.

7 Indicators of "Irrational Exuberance" in Real Estate

As we just discussed, the Case Shiller HPI is higher than it was just before the GFC. And it’s not just a few markets. It’s pretty much every single major metro area, even when you adjust for inflation & interest rates[2] – Two of the primary drivers of house prices.

There are 2 main measurements of house prices to income:

- Price to Income Ratio

At approximately 6, the median price to income ratio is higher than it has been going back to 1984.

2. Mortgage Payment as a % of Median Household Income

A mortgage payment on the median priced home as a % of median household income is the highest since 1990.

This shows the current payment on the median priced house consumes 36% of a median household’s income, higher than the peak of the GFC.[3]

The only other time in this data set that was higher was in 1984 when it was at 45%! This is possibly the highest reading ever, driven by sky high interest rates at that time.

If you think 36% is bad, it doesn’t account for Income taxes, property taxes, homeowners’ insurance, or mortgage insurance. If we add those in, we’d likely be looking at 50% or more of the median household income going towards housing costs.

The Price to rent ratio is exactly what it says. You take the median price of a house & divide it by the median rent. This is important because it can give us a gauge of emotion in the housing market.

You generally have two choices when deciding where to live. You can either buy or rent.

When house prices diverge from rents, & people are making the decision to pay $500, $600, $700 more per month to own a home it can be a sign that people are basing their decisions on emotions rather than logic and financial planning.

This is a chart from the website Calculatedriskblog.com which is based on a 2004 study of the federal reserve.[4]

He uses the same approach that the Fed used to calculate the ratio through 2022. As you can see, we are back to the peak that we saw in 2006 right before the GFC.

Fear of missing out is the existence of unusually high demand due to the fear that they won’t be able to afford it if they don’t get in now.

In real estate, we look at 4 primary metrics to gauge buyer demand & sentiment:

- High Sales to List Ratio

As you can see, sellers have had to reduce their list price between 2-4% to sell their property since 2012. Starting in 2021, sellers have been able to sell their homes for more than their list price reaching a max of approx. 103%. An all-time high in this data set.

In addition to the high sales to list ratio, the % of homes that sold above asking is a whopping 60%. Over the 2012-2020 period, it sat at about 25%. That’s a doubling in the % of homes that sell for more than asking, signaling insane demand & FOMO.

2. % Price Drops

Over the 2015-2020 period, the avg % of homes with price reductions sat at ~12-13%. Since the start of 2021, that rate decreased to about 10% further supporting the notion that sellers had control of the market since 2021.

3. Days on Market

This trend of significantly lower days on market is obvious. Since 2012 it has dropped from 97 days to 16 ,an 84% decline! Of course, 97 days was recorded at a time when we were just coming out of the GFC, which is why it’s so high.

The normal days on market is somewhere between 45-60 days. The current rate of 16 days is a sure sign of excess demand.

4. % Pending within 2 Weeks

Couple the prior 3 metrics with an explosion in the % of homes entering pending sale status within 2 weeks of listing & it’s not hard to see the presence of FOMO in the housing market.

Low supply of anything, provided there is a demand for it, will push the price up. Furthermore, the price will explode if demand is high while supply is low.

We’ve already established the presence of excess demand for residential real estate. Couple that with extremely low inventory, & it’s no wonder why we only have 1-2 months’ supply of homes right now, which is a historically low rate.

In the years leading up to the GFC, which nobody will argue that we were not in a bubble at that time, we were running at about 4 months’ supply.

Now, I can hear some of you screaming at your monitor…..But Leif, the low supply will put a floor under real estate prices. This is true….for now.

You see, when the difference between the price a house can sell for & the cost of building that house increases, this gives a signal to builders to build more because the profit margins have increased. And build they have!

The chart below shows the total # of units under construction hit an all-time high going back to 1970.[5] This is inventory that will likely hit the market over the next 3-18 months & almost surely at lower prices. We are already seeing homebuilders discount their recently completed properties.[6]

This is the % of all home purchases by investors. According to RedFin, Investors bought a record 20% of all sales in Q1 2022.

The theory is that the proportion of investors is important because they’re more likely to be the first to unload their properties & stop buying more if the market starts to fall.

This is particularly true for flippers because they get clobbered if prices are falling. Rising or flat prices are required for their business model to work. Publicly traded companies like Blackrock & Blackstone must adjust the value of their assets to the current market value for their quarterly earnings reports. If prices start falling, this hurts their earnings numbers which has tons of downstream effects on their business.

However, the data doesn’t fully support this claim that investors flee at the first signs of trouble. It absolutely was the case at the beginning of the pandemic where you can see that investors fled like their hair was on fire. Historically Q2 is a time when investors are quite active. In 2020 that wasn’t the case. Their market share went from 17% in Q1 2020 down to 11% in Q2.

Investor market share did not fall during the GFC, however, so we need to take this significant rise in investor market share lightly when we’re using it as evidence of a housing bubble.

Other than tight supply, the main pushback on the argument for a housing bubble is the fact that the underwriting appears to be much better than it was leading up to the GFC.

For the most part this is true but there are a couple of data points that are interesting so let’s take a look.

There are 5 main metrics to track the quality of underwriting:

- % Adjustable Rate Mortgage loans

Adjustable-rate mortgages (ARMs) allow a borrower to pay a much lower interest rate in the first several years of the loan. It resets to a higher rate later on. As prices or interest rates increase, it’s common for ARM originations to increase as well. Particularly in the higher price ranges.

In fact, this is exactly what we’re starting to see now that prices are sky high & interest rates have started to climb.

While the current % of ARMs (10% of recent applications) is the highest we’ve seen in 14 years, it’s nowhere near what it was leading up to the GFC (35%).

In fact, ARMs still only comprise 4.7% of total outstanding loans as of March 2022[7].Compare that to the 35% leading up to the GFC & it’s apparent that ARMs should not be a problem. It’s very unlikely we’ll get forced selling because their interest rate resets to a level that they can’t afford.

2. LTV/CLTV

LTV & CLTV stand for loan-to-value & combined loan-to-value, respectively.

The interesting thing here is that the avg CLTV of conforming loans was actually higher over the 2017-2019 period than it was leading up to the GFC. [8]Conforming loans make up the overwhelming majority of originations.

Because of the run up in prices over the past few years, these loans should have plenty of equity to absorb a moderate fall in real estate prices provided we don’t get a surge in layoffs.

In my opinion, That’s the x-factor which will determine if we get a crash in housing prices or not. If people keep their incomes flowing at pretty much the same level, they will be able to absorb some sizeable price drops without having to go into foreclosure like they did in the GFC. However, if layoffs surge, all bets are off.

Homeowners will choose to sell their property while they still have some equity in it, further increasing the inventory we’re already starting to see, & driving prices down.

3. Avg FICO

There’s no doubt that FICO’s have improved significantly.

Keep in mind however, that there have been moratoriums on late charges & fees, evictions, student loan payments etc. Therefore, this may not show the true story. Had the moratoriums not been in place in 2020 when millions of people we’re laid off, late payments & evictions would have skyrocketed which would absolutely have reduced credit scores.

4. Avg Debt to Income Ratio (DTI)

Debt to income ratios are just about the same as leading up to the GFC. Problem is that this also has been affected by the moratoriums & stimulus payments.

Notice the large spike in the jumbo loan DTI’s. That’s interesting

5. Cashout Refi’s

Cashout refi’s aren’t nearly as large a portion of total originations as leading up to the GFC, but we have seen a fairly significant increase over the past year or so. We’ll have to keep our eye on that.

According to Blacknight, a mortgage data tracking firm, homeowner equity is at an all-time high & about double what it was leading up to the GFC.

Additionally, homeowners have been extracting only about 6% of their equity over the past several years. This is much lower than the 16% leading up to the GFC.

Because of this, most analysts conclude that the increase in cashout refi’s should not be a problem.

That wraps up my case that the largest risk to a real estate investment is currently the housing bubble. Housing prices adjusted for inflation & interest rates are at or near all-time highs in almost every single major market.[2] Prices to incomes & rents are at multi-decade highs. [3][4] The signs of excess demand & FOMO are undeniable.[9] Tight supply looks like it’s reversing since homebuilders have started the most units going back to 1970. [5]

This doesn’t necessarily mean that you shouldn’t invest in real estate right now. Of course, if you do & we get another huge crash then you will be underwater for quite some time.

But if you can keep a paying tenant in your property, you will continue to collect rent checks while the loan pay down & eventual increase in prices will get you back into an equity position.

Not to mention that if the Fed goes too far like it did in 2018, & they have to quickly reverse course & start doing QE again, we could see residential real estate take off once again.

Other risks that you face with an investment in physical residential real estate include:

Poor Liquidity

If you need cash quickly for any reason, it generally takes at least 30 days to sell your property & receive the cash. And that’s for a cash offer from an investor who will close within 30 days. Most transactions will take 60-90 days to fully complete.

Location Risk

Location is so important to real estate values that negative changes in the area where you own property.

(i.e., Increased crime, reduced school performance, undesirable businesses moving in, increases in homelessness etc.), can reduce not only the price of your property but it can reduce rents & make it harder to find a tenant in the first place.

Both of these will reduce the cash flow & total return of your investment. It’s not like you can pick up the property & move it to a better area.

Bad Tenants

One of the main reasons to invest in real estate is to generate a monthly cash flow. To achieve this, you need to have a tenant in your property. One risk lies in the chance that you rent to someone who doesn’t know how to take care of a property.

It’s quite common for tenants to ignore small problems that can turn into a big problem if not taken care of quickly.

There is also the possibility you’ll have to evict a tenant which can be very costly & time consuming.

To avoid these, make sure you have a thorough screening process in place and always:

- Conduct a credit check

- Get references – especially the prior landlord

- Require a security deposit

Vacancies

Vacancies are pretty much a certainty in real estate investing. No matter what you do, it’s pretty much guaranteed that you will have a period of time where nobody is renting your property. This leaves you on the hook for the mortgage payments over that period.

Because of this, you must make sure to account for this in any calculations you make when looking for an investment property. Vacancy rates can range from 3-4% in some areas & up to 10-15% in others. Talk to a real estate agent or better yet, a property manager, for an estimate of vacancy rates in your target area. You can also get a high-level estimate of vacancy rates by metro area from the US Census website. It’ll give you a usable rate for your model until you’re able to talk to a real estate agent or property manager.

The best ways to minimize vacancies is to

- Charge a competitive rent

- Have a good tenant screening processes in place

- Know the amenities that are desired by renters in your area

- Invest in good locations with low crime, good schools, close to shopping, nightlife & transportation

- Keep the property in good shape

- Develop & maintain a network of potential renters, agents & property managers

- Advertise

Wear, Tear & Major Repairs

This is also a fact of life when investing in real estate. There is the normal wear & tear & then there are major repairs such as a new roof, electrical problems etc. These can cost you thousands & even tens of thousands of dollars.

The 3 main things you can do to minimize the impact of these are:

- Account for them in your calculations prior to investing in a property

- Set aside a portion, usually 10-15%, of the monthly rental income to cover these types of costs

- Stay on top of any repair needs & get them done quickly – This will help keep future costs low

- Buy a home warranty

- This can help avoid any nasty surprises in the first few years of ownership

- Keep in mind that this guarantees a reduced cash flow & we all know how insurance works. There will be several costs that the warranty won’t cover. So, make sure you fully understand what is and isn’t covered by a home warranty, & plan accordingly.

Legal Risks

Once you own a property, you’re at risk of many things happening on or by your property that can result in you being sued or having to pay someone. Someone can trip on a crack on your property, a tree on your property could fall & crush your neighbor’s car etc. If the property is in your name, all your personal assets could be at risks of being seized or liquidated to pay for the damage.

The primary way to avoid this is to hold the property in an LLC or some other legal entity that is separate from you. This way, only the assets held within the entity are at risk, not your personal assets like your IRA, savings etc.

ALWAYS Consult a Legal Professional

I’m just a dude on the internet with some experience in real estate giving you information & education, not financial or legal advice. I am not an attorney, & all legal matters should be discussed with a qualified legal professional.

Asset Seizure or Liens on the Property

As I mentioned in the article on real estate & diversification, real estate is a large physical asset that is easily traceable, easily seized, or a lien placed on it by the state should you do something they don’t like. The probability of this is quite low but low is not the same as 0.

Negative Cash Flow

Many of the risks outlined so far lead to a reduction in cash. If you are unable to cover that cash flow deficit out of your own pocket, it could lead to the next risk of investing in real estate which is

Default/Foreclosure

There is a real possibility that one or more of the risks already mentioned put you in a position where you must cover some or all the mortgage. If you are unable to do so, it could result in the bank foreclosing on your property. If this happens, all the money & energy you put into the property would be for nothing.

To minimize this risk, take the steps I’ve already outlined above to avoid bad tenants, minimize vacancies & repair costs etc.

Additionally, you should have a larger cash reserve than you otherwise would have. If you normally hold 3-4 months of living expenses in cash, you should probably bump that up to a minimum of 6 months.

Scams & Fraud

Just like any other part of your life, pay attention & make sure nobody is trying to rip you off. This is particularly important when investing in a property a long way away.

It’s always wise to go see the property, get a feel for the location of the property, & meet the agent or any other people involved in the purchase. If you’re unable to do this, make sure to scrutinize all the documents you receive and agreements you enter into.

Large Upfront Costs

To avoid having to pay mortgage insurance, which adds to your monthly costs & reduces your free cash flow, you’ll have to put 20% down. This means that you’re looking at a minimum of $20-30k, & more likely $40-50k, just to invest in a property.

There are, however, several ways to buy real estate without putting much more than 3.5% down. You will pay more for that privilege though through a higher monthly payment.

The best resource I’ve found for beginners to understand the various ways to finance real estate deals, including how to put 0% down or get a loan that will wrap any renovation costs into the loan, is “Investing in Real Estate with No (& low) money down” by Bigger Pockets.

The final risk to a real estate investment is one that you directly control.

Poor Due Diligence

Proper due diligence applies to any investment, not just real estate. Unless you have significant experience investing in real estate, I strongly suggest you learn, learn, learn & then learn some more before buying your first investment property.

In fact, you should never stop learning when it comes to real estate because it’s a very localized investment. An important employer could leave the area or even just freeze hiring in that location. Rental controls can be enacted in the city where your property is located. The area could see increasing crime or decreasing school quality & much more.

All of these could derail your expected returns on a property. Staying on top of such developments could be the difference between generating the returns that you expected when you purchased the property & generating no return, or even a loss.

There is a treasure trove of data out there. Some is paid but a great deal of it is free. To help you with your due diligence, I put together a list of all the resources I’ve found in my years of real estate investing.

Being able to pull the data to find places to look is very valuable. But the most valuable resource you can get is a real estate agent or a property manager in the area that you’re looking at.

If you find a good one, they’re going to fully understand their market & can help you understand the nuances of the market & the cities & neighborhoods that will fit your goals the best.

Well, that wraps up the major risks of investing in residential real estate. As you can see, there are tons of them. But don’t let this long list scare you away from getting into real estate. Provided you do your due diligence, understand the risks & do what you can do to mitigate them, & don’t let emotion control your investment decisions, the benefits will most likely outweigh the risks. If they didn’t then nobody except the rich would invest in residential real estate.

Now that you understand the benefits & risks of residential real estate, the last component an informed investor needs to know is how much you should allocate to real estate. This is the final section in our deep dive into residential real estate & I hope you’ll check it out.

[1] “US Home Prices 180-Present” Robert Shiller & Karl Case. http://www.econ.yale.edu/~shiller/data.htm Accessed 8/26/2022

[2] “Real Monthly Principle & Interest Price Index: Case-Shiller Home Price Index Adjusted for Inflation & Mortgage rates (1990 Baseline).” John Wake, RealEstateDecoded.com https://realestatedecoded.com/case-shiller/ Accessed 8/26/2022

[3] Federal Reserve Economic Data. FRED database. Series: MSPUS, MEHOINUSA646N. https://fredhelp.stlouisfed.org Accessed 8/26/2022

[4] “The Long-Run Relationship between House Prices and Rents”. by Joshua Gallin. https://www.federalreserve.gov/pubs/feds/2004/200450/200450pap.pdf Accessed 8/26/2022

[5] New Residential Construction. US Census Bureau, US HUD. https://www.census.gov/construction/nrc/historical_data/index.html Accessed 8/26/2022

[6] “Homebuilders Are Now Offering Deals, Incentives on New Construction to Lure Buyers”. By Louise Witt. https://www.realtor.com/news/trends/new-home-construction-deals/ Accessed 8/26/2022

[7] Percent of Adjustable Loans. John Burns Real Estate Consulting. https://www.financialsamurai.com/adjustable-rate-mortgages-as-a-percentage-of-total-loans/ Accessed 8/26/2022

[8] FHFA, National Mortgage Database. https://www.fhfa.gov/DataTools/Downloads/Pages/National-Mortgage-Database-Aggregate-Data.aspx Accessed 8/26/2022

[9] RedFin Data Center. https://www.redfin.com/news/data-center/ Accessed 8/26/2022

Get Our Latest Delivered To Your Inbox

You will receive 1-2 emails per month and you can unsubscribe at anytime