In the first article of this 5 part series , we covered the 5 ways to make money in residential real estate. Our next question is “is residential real estate a good inflation hedge?”

As I dug into the data, I realized you have to look at that question from 2 different angles. First, does it beat inflation over long periods of time? Second, how does it do during shorter term spikes in inflation?

Summary

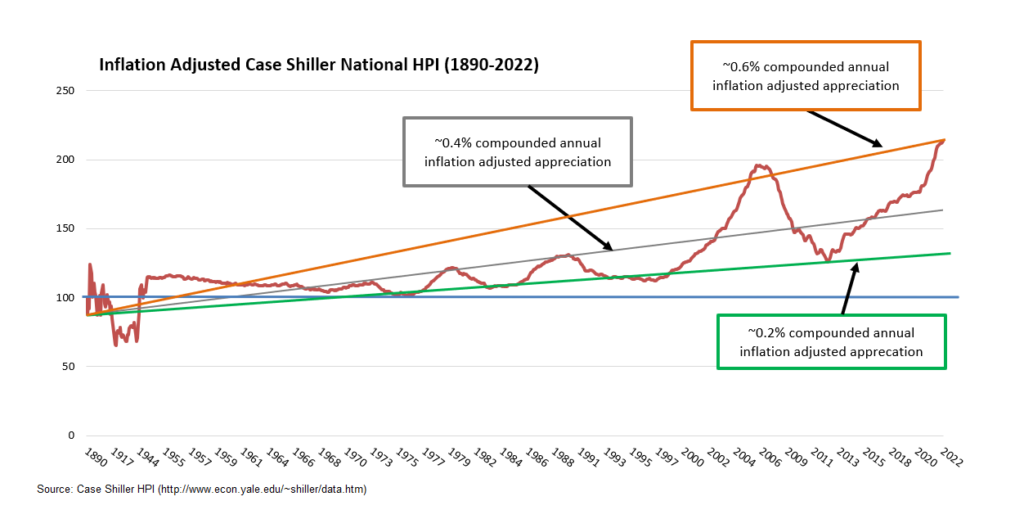

- Residential real estate has outperformed inflation by approx. 0.4% compounded annually since 1890

- During shorter term inflation spikes, it’s more mixed

- On an annual basis, it trailed the CPI 71% of the time when the CPI >= 5% since 1890 & underperformed by 3% on average

- Over rolling 10-year periods, it trailed the CPI 43% of the time & performed inline with the CPI on average

- Residential real estate is iffy when it comes to inflation protection when only considering price appreciation.

- Renting a property out to capitalize on cash flow & tax benefits boost returns enough to consider it an effective long-term inflation hedge

Real Estate vs Inflation - Long Run

It beats inflation by approx. 0.4%/yr compounded annually – That’s the grey linear regression-based trend line.

If you consider the real trend to be at the lows of each cycle once all the malinvestment gets washed out, which is the green line, then it beats inflation by 0.2%/yr compounded annually.

I don’t think a strong case can be made that the orange line is the right long run trend line & even that beat inflation by only 0.6%/yr compounded annually.

Real Estate vs Inflation - Short Term Spikes

During shorter periods of inflation spikes, the results are more mixed with national house prices tending to rise less than inflation.

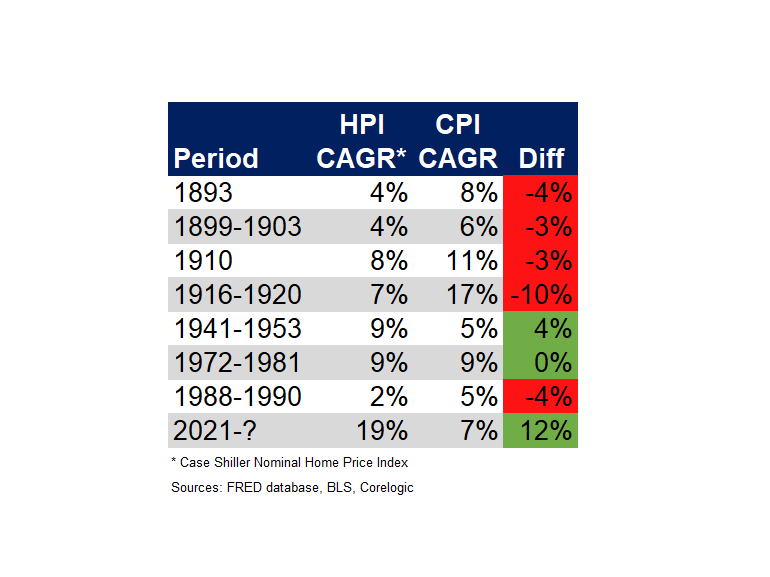

Since 1890, we’ve had 7 periods of high inflation which I define as a 5%+ annual increase in the CPI.

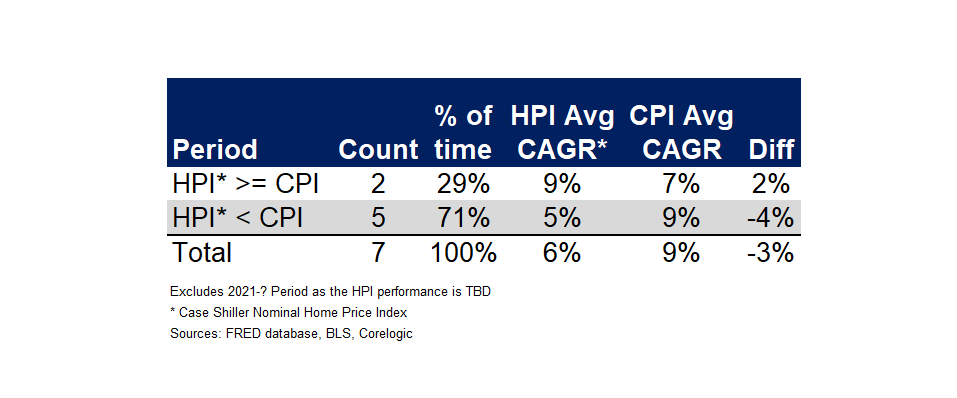

Of the 7 periods where the CPI increased by 5%/yr or more, national house prices, as measured by the Case Shiller HPI, trailed the CPI 71% of the time & returned an average of 3% less than the CPI over those periods.[2]

However, it’s important to note that even though house prices underperformed relative to the CPI, they still increased in ALL periods. They just didn’t increase enough to offset inflation which means you lost purchasing power. You didn’t actually lose money, just purchasing power.

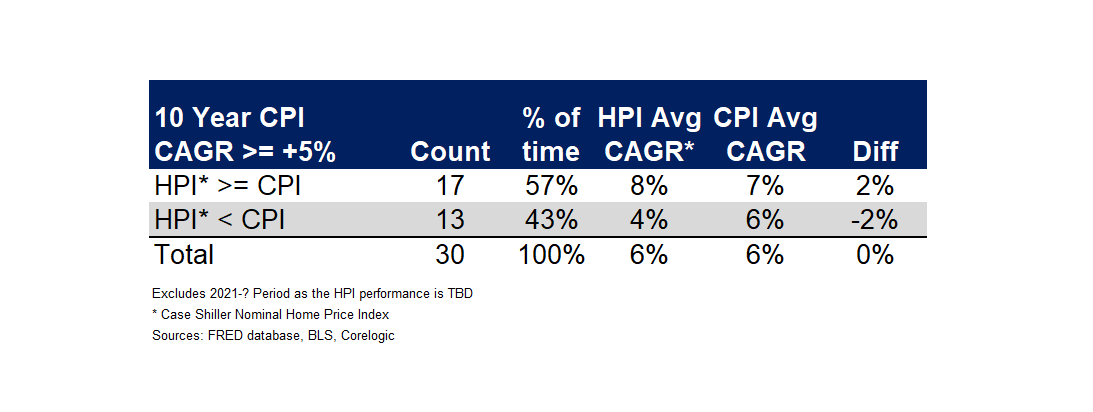

I also looked at the 10-year compounded annual growth rates of the Case Shiller HPI vs the CPI.

Of the 30 rolling 10-year periods with an avg annual CPI of 5% or higher, national house prices trailed the CPI 13 times or 43% of the time & they trailed the CPI on average by 2%.[2]

On the flip side, national house prices beat the CPI 17 times or 57% of the time & they beat the CPI on average by 2%.[2]

To sum all this up, real estate prices tend to underperform inflation during short spikes in the CPI but over periods of 10 years or more, real estate prices keep up with inflation & over super long periods of time, they will slightly outperform inflation.

Keep in mind that we have only discussed changes in the price of residential real estate. Don’t forget that by renting the property out you can capitalize on cash flow opportunities & tax benefits. This will significantly increase your chances that a real estate investment will outperform inflation over any given time frame.

So that concludes this discussion on the ability of residential real estate to protect your financial wealth from the theft that is inflation. But an astute investor should also consider the effectiveness of residential real estate as a diversifier within a traditional stock-based portfolio.

[1] “US Home Prices 1800-Present” Robert Shiller & Karl Case. http://www.econ.yale.edu/~shiller/data.htm Accessed 8/26/2022

[2] S&P/Case-Shiller National Home Price Index vs Consumer Price Index for all Urban Consumers: All Items in U.S. City Average (1987 = 100). https://fred.stlouisfed.org/series/CSUSHPINSA#0 Accessed 8/26/2022

[3] Credit Suisse Global Investment Returns Yearbook 2022 Summary Edition. Credit Suisse Research Institute. Elroy Dimson, Paul Marsh, Mike Staunton. https://www.credit-suisse.com/about-us-news/en/articles/media-releases/credit-suisse-global-investment-returns-yearbook-2022-202202.html Accessed 8/26/2022

Get Our Latest Delivered To Your Inbox

You will receive 1-2 emails per month and you can unsubscribe at anytime