A spending plan is not a document like a budget. It's how I spend to implement my budget in the real world.

- Adaptable Wealth Tweet

It’s reasonable to think that a spending plan is the same as a budget, but with a different name. To an extent, it’s true. A budget is indeed a plan for how you will spend your money.

The funny thing is that personal finance pundits think that if you just refer to a budget as a spending plan, people will embrace it with open arms. Uh…. no. We don’t need a new phrase to try to trick people into accepting that hard work is required to win with money. We need something that will save time and effort and make it easier to the stick to your budget.

Then there is the blogger who will actually provide a different way of thinking about a budget. Just go with a 50/30/20 proportional budget, they say. If you have good control of your finances, this may be an option for you. Unfortunately, most of the world is not in this position. Even if you are on good financial footing, you’re robbing yourself of the thought-provoking, financial goal setting process that is budgeting. If you half ass your budget, you’ll get half assed results. Proportional budgeting is half assed budgeting. Plain and simple.

Although I don’t recommend cutting corners on the budget process, I have found a way to simplify the spending process. It also makes comparing your budget to what you actually spent much easier. I call it a spending plan because it’s my plan for how I will spend my money on a daily basis. It’s not a document like a budget, it’s how I actually carry out my spending to implement my budget.

Summary

- A budget is a roadmap that reflects your income and your priorities, values and desires as manifested through your spending.

- If done properly, you end up with the following:

- an understanding of where you’re at

- A prioritized list of your expenses in case have to cut at some point

- A view of where you want to be financially in 6-12 months

- A list of goals to get you there.

- A spending plan is how you implement your budget in the real world.

- A spending plan is a dynamic process, not a document.

- Most commentators take a budget, cut corners, remove the valuable parts of creating a budget & call it a spending plan – No thank you!

- I’ve put together a 9 step process for translating your budget into a real world spending program, saving you time and energy, and making it easier to stay within your budget.

What is a budget?

A budget is a roadmap that reflects your income and your priorities, values and desires as manifested through your spending. If done properly, you end up with an understanding of where you’re at, a prioritized list of your expenses, an idea of where you want to be financially in 6-12 months, and a list of goals to get you there.

For many people budgets are a no go. They can be time consuming, boring and they just feel so damn restrictive.

On the other hand, going through this thought-provoking process can leave you feeling powerful, inspired and in control of your finances.

I know it sounds like a lotta work. It is. But ask anyone who is successful in life, and they’ll tell you that you get what you put in. If you half ass your budget, you’re going to get half assed results.

Pros & Cons of a Budget

Pros

Promotes long-term thinking and planning

- Gets you to prioritize your goals, values and desires

- Allows you to develop step-by-step financial goals to get you from where you are today, to where you want to be

- Promotes an in-depth knowledge of where your money comes from and where it goes

- Puts you in control of your financial future

Cons

- Can be very time consuming (if you do a detailed or traditional budget)

- It’s worthless unless you commit to following it

- It’s hard to stick to a budget because it’s easy to see a budget as a plan that tells you what you can’t do rather than what you can do

- Can create stress and feelings of failure related to your finances

While a budget should be done with your full attention and thoughtful planning, spending your money doesn’t have to be. That’s where a spending plan comes in.

What is a spending plan?

Whereas a budget is the roadmap for your spending and financial goals, a spending plan is how you actually spend your money in the real world.

The thing that confuses me is nearly everyone I talk to thinks that you have to spend the exact same way that you budget. I assure you that this is not the case.

For many people, especially those who do not have a spending problem, we can capture all the benefits of following a budget while saving ourselves time and energy. All you do is put your variable expenses into a separate account, then make sure you don’t spend more than what’s in that account.

Pros & Cons of a Spending Plan

Pros

- Gone are the days of tracking your spending at the line item level

- Reduces stress related to your daily spending

- All your savings and financial goals will be met provided you don’t spend more than what’s in your spending account

- Takes minimal time to implement

- Dealing with only a few items to keep track of makes it much easier to know what you can and can’t afford

- Promotes automation of your savings, investments and bill paying

Cons

- You can still overspend if you don’t do the mental accounting

- You still have to monitor what you spent and what you have left to spend on some necessities such as groceries and gas

- Is worthless if you’re going to pull from your savings account in the event that you use all your free spending money

- Will not protect you from unexpected expenses that are not in your budget

Because the concept is so simple, and it has saved me a ton of time and energy, I felt the need to share it with those who are killing themselves tracking every penny.

A spending plan: step-by-step

Step 1: Create a list of your income & expenses (i.e., a budget)

Thought you were gonna get out of this didn’t ya.

A traditional budget is best but any accurate list of your income and expenses will do. You can see my approach to budgeting (summary, in depth)

You can also use our budget template if you’d like. Simply make selections and entries on a form and a 12-month budget populates itself. I promise you; it will save you quite a bit of time.

Don’t forget a line item for saving, investing and your other financial goals because you should ALWAYS…

Step 2: Pay yourself first

Pay yourself first is a catchy slogan that just means before paying anything, take 10-30% off the top and put it towards saving, investing or another one of your financial goals.

Aim for 20-30% but start with 10-15% if you can’t afford it right now. You can always work your way up.

If you can’t afford to save 10% at this moment, it’s time to start thinking how you’re going to either increase your income (2nd job, side hustle etc.), cut expenses, or both.

I implore you to find a way, any way, to get this going TODAY. Saving done right is done over a long period of time. It will allow you to enjoy a consistent portion of your hard-earned money rather than having to starve your spending desires with the goal of catching up. If you wait too long, you will either end up not having enough money in the future or you will end up miserable because all extra income must be plowed into savings to catch up.

For example, let’s say your goal is to save $50,000 over a 5-year period. If you start saving on day one, you will have to save $10,000 per year ($833 per month). If you wait until the end of year 2 (because you couldn’t “afford” to save until then), you’ll have to save $16,667 per year ($1,388 per month). It doesn’t take a genius to realize that it only gets more difficult the longer you wait.

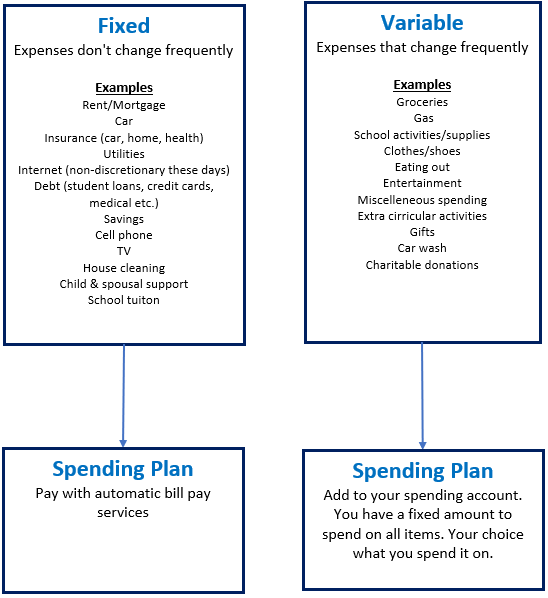

Step 3: Segment your expenses between fixed & variable

Just to reiterate, savings and investment have already been moved to their appropriate accounts in step 2. This splitting of expenses between fixed and variable applies to what is left over.

Fixed Expenses

Expenses that are fixed in nature or do not change much. These tend to be the non-discretionary necessities such as Rent/mortgage, utilities, debt payments etc.

There are also discretionary items such as cell phone, house cleaning and TV in this bucket because we’re focusing on fixed vs variable expenses (rather than discretionary vs non-discretionary) that you spend on daily or weekly.

Variable Expenses

Expenses that change quite frequently. These tend to be the discretionary things such as eating out, entertainment and misc. spending. It also includes necessities such as groceries and gas because the amount you spend changes from week to week, and you spend on them multiple times each pay period.

Step 4: Put all your fixed recurring expenses on autopay

For vendor payments on items such as mortgage, car payment, cell phone etc., use your bank’s bill pay feature.

Savings and investments can and should also be put on auto draft. whether you are only contributing to an emergency fund at the moment, or you’re contributing to an emergency fund, retirement savings and saving for a house, all of these should be on auto transfer. This way you don’t have to think about it.

From personal experience, I can honestly say that automating my savings has helped enormously to save what I have been able to save.

Step 5: Add up the variable expenses

The total amount should be a metric in your budget, so you know exactly how much goes in this account each pay period.

Step 6: Open a separate checking account

This will be your spending account

Step 7: Move the variable expenses into the new checking account

Pro Tip!!!

Call your payroll department and ask them to split the direct deposit of your paycheck between your two checking accounts. You simply have them direct deposit the amount calculated in step 5 into the new account. The rest goes into the original account. Now there is no need to set up transfers yourself.

Step 8: Spend out of your spending account for daily expenses

This is where you get a little bit of control back. All you have to do is make sure you don’t spend more than the amount in the spending account until your next pay day.

Gone are the times of counting every penny.

However, you can still get yourself in trouble if you’re not careful. You still need to be an adult and go through mental accounting exercises before you go spend any money left over from another category.

Say you spend $75 on groceries but you budget $100. You have 3 choices:

- Save the extra $25 for one of the other items such as next week’s groceries or maybe you committed to see grandma this weekend and that is going to result in a little more gas than usual.

- You’re on a mission to build your emergency savings or pay down debt. You could put the money towards those.

- Say flip it! I want to have some me time. Never feel guilty spending on yourself if you’ve saved some money elsewhere. As long as there is a balance, you’re not in debt and you have at least 3 months of cash savings.

Step 9: Don't forget to track your performance

If you only spend what is in your free spending account and never go over, then you have nothing to track. By not spending more than what you put in your spending account, you already know that you’re meeting your spending goals.

If you do go over, then you should take the time to pinpoint why.

I know it’s not much but at least it’s something to reduce the time and stress spent worrying about every penny. It also gives you some control and flexibility.

This is how I manage my spending and it has helped a lot. I won’t lie though, there are times when I overspend and end up having to cut into my groceries or gas. You still need to be careful and do the mental accounting. The rest takes care of it’s self because it’s on auto pilot.

The time you save can be used for mental health time, exercise, sleeping or what ever the hell you want! These are also important to your total wealth-being, of which financial health is one part.

If you struggle with money or the mental accounting of your spending, I recommend you stick to a stricter method until you’re ready.

The spending plan: a dynamic process, not a document

As you can see, the spending plan is a process by which you streamline your spending on the items you buy every day. It is a dynamic process that will change over time based on your income, your savings goals, your expenses and your priorities, values, and desires.

For example, if your income increases while your expenses stay the same, you can save more or add at least a portion of the increase to your free spending. But if your expenses increase while your income remains the same, you’ll have to reassess. Should you take the deficit out of your free spending, or can you cut something else out to keep the balance? Whatever you decide is the right answer! As long as you stick to your spending plan, you’ll be just fine.

So, stay adaptable and enjoy the new way of spending without meticulous tracking. You are on your way to meeting your financial goals while saving time and reducing stress. Yes please!

Get Our Latest Delivered To Your Inbox

You will receive 1-2 emails per month and you can unsubscribe at anytime