Real estate investing, even on a very small scale, remains a tried and true means of building an individual’s cash flow and wealth

- Robert Kiyosaki Tweet

This is the first article in a series of 6 which covers pretty much everything you need to know about residential real estate investing. We start off with how you make money, whether it’s a good inflation hedge or portfolio diversifier, & the intrinsic value of real estate. After an in-depth look into the risks involved with investing in a rental property, we wrap it up with important considerations when determining the proper allocation within a portfolio.

The thing that intrigues me about residential real estate is that it’s unlike any other investment because there are 5 ways to make money, and lots of it. Almost every other investment like stocks, bonds, crypto, precious metals, art, or cars offer one or maybe two ways to make money.

And I’m not talking about obscure strategies pushed by guru’s promising millions in profits if you just follow their 5-step process. I’m talking about straightforward, no non-sense sources of financial wealth creation that anybody with a pulse can take advantage of.

You only need to purchase a property & pay the mortgage to take advantage of 2 sources of financial wealth creation. Treat the property like an investment & rent it out, & 3 more sources become available to you.

Summary

- Investment properties open a whole new world of wealth building

- Real estate allows you get enormous amounts of leverage

- Unlike other investments, real estate offers 5 ways to make money:

- Cash Flow

- Can be used to offset inflation, invest in other assets or buy other cash flowing properties

- Market Based Price Appreciation

- Based on supply/demand factors

- 3-6% nominal returns compounded annually

- Forced Price Appreciation

- You can increase the price of a property by fixing it up or adding desirable amenities

- Loan Paydown/Amortization

- Either you pay down the loan or you can rent it out & a tenant can pay it down for you while you reap the benefits of more equity

- Tax Benefits

- Requires that you rent the property out

- You can depreciate a residential property over 27.5 years

- You will have to pay a portion of the depreciation back when you sell the property (Depreciation recapture)

- Use the 1031 exchange to avoid depreciation recapture

- Cash Flow

Cash Flow

The first way to make money in real estate is through cash flow. This is the difference between money coming in from the property & money going out to operate, maintain & pay the mortgage. Think of it like a checking account. Money comes in, money flows out.

However, money comes in only if you rent out the property or employ it in some type of work. If you don’t rent any part of it, you’ll only have money going out. In other words, you’ll have a negative cash flow that you will have to cover out of your own pocket each month.

I’m not sure about you but I don’t want to have to keep funding an investment out of my own pocket. I want that investment to pay me on a net basis instead.

Cash flow is good because it creates a baseline return on your investment & you can use the money for whatever you want. You can use it to:

- Deal with the impact of inflation by using some of it for living expenses

- You can invest it in other assets with the goal of building a well-diversified portfolio

- You can also use the cash flow from the first property to finance the acquisition of the next one which should also generate a positive cash flow.

In my opinion, the 3rd option is the smartest use of the funds.

Equity

The next 2 real estate wealth generators fall into a category called equity.

Equity is simply the difference between the price you can sell a property for & what you still owe on it.

Whereas cash flow is your checking account in real estate, think of equity like your savings account. It accumulates over time and is available for withdrawal should you need the funds.

Cash flow is nice, but the drivers of equity are where the “real” wealth generation occurs because of the leverage you can get with a mortgage.

The 1st driver of equity gains in residential real estate is

Price Appreciation

There are two types of price appreciation: Market based & forced price appreciation:

Market Based Price Appreciation

This is the increase in the price of a property over time due to supply/demand factors such as location, incomes, demographics & the number of new homes being built in the area. The good news is that the only thing you must do to capitalize on this type of appreciation is keep up the property to make sure it remains desirable.

Price appreciation is the primary driver of wealth creation because you’re able to get enormous amounts of leverage in real estate.

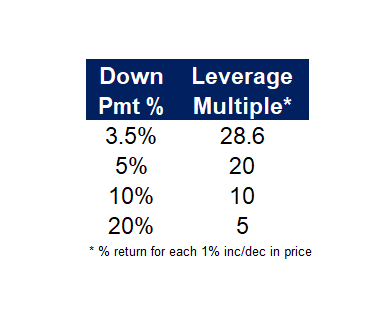

Depending on how much you put down, you can get a 5%, 10%, 20% or 28.6% return on your investment (i.e., your down payment) for every 1% increase in price.

Additionally, the high price of real estate means the absolute dollar return is amplified as well. For example, if you get a 28.6% return on $1,000 it’s a nice rate of return but the absolute dollar increase of $286 is not life changing. Move that up to a 28.6% return on $100k ($29k), $200k ($57k) or $300k($87k) and we start talking about some real money.

This is why real estate has played such a significant role in the building of so many fortunes. You’re dealing with large dollar amounts and you can get tons of leverage to amplify your returns.

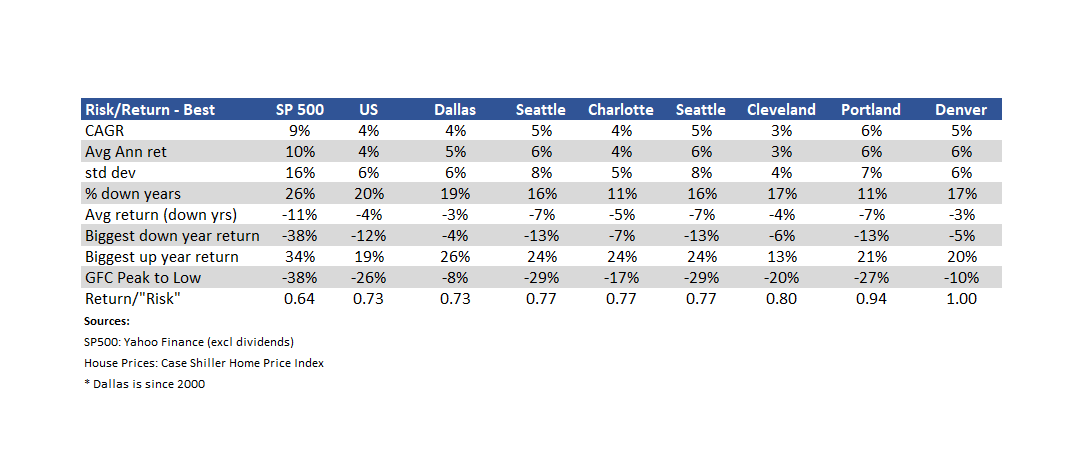

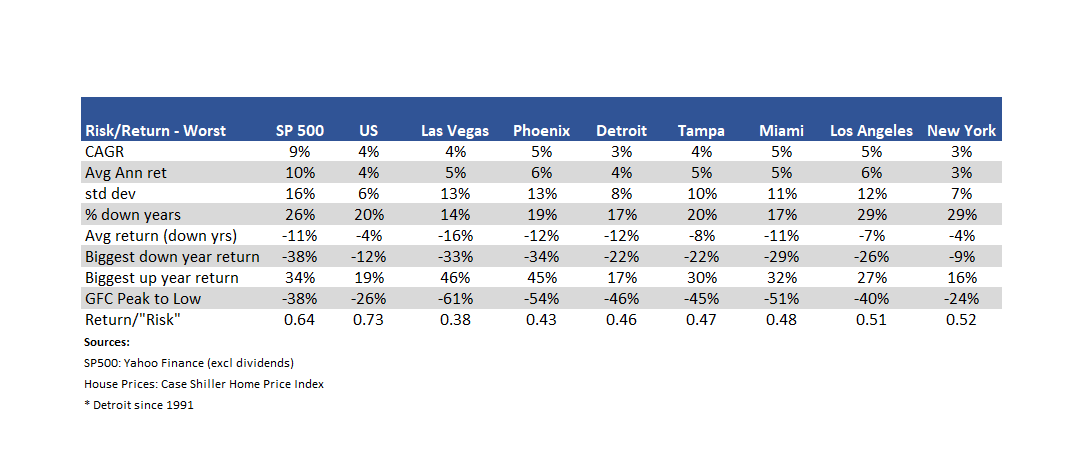

Based off the Case Shiller Home Price Index (HPI) since 1987, you’re looking at a 5-6% nominal return due to market-based price appreciation in the top performing markets & a 3-4% nominal return in the lower performing markets.[1]

Compare that to the 9% return of the S&P 500 over the same period[2] & you’ll see why I say stocks are hard to beat & are the best wealth builder for the average person. Especially if you’re just starting out.

The 2nd driver of price appreciation is:

Forced Price Appreciation

This is where you make improvements & watch the price of the house increase by more than what you spent on improvements.

For example, you can put 20% down on a $100k property then spend $20k remodeling the bathrooms or kitchen. It’s not uncommon for such an update to result in a $60k increase in the homes price right off the bat. You spent $40k to get the property & remodel it, now the house is worth $60k more. That’s a 50% ROI & you haven’t even started to accumulate wealth through cash flow, market-based price appreciation or our 4th way to make money in real estate:

Loan Paydown (AKA Amortization)

This is the last way to build wealth through equity, and you have 2 options:

- You pay the mortgage down

- You rent the property out & your tenants pay the mortgage down for you!

Which one sounds better to you? This is why rental properties make so much sense.

Provided you don’t default on the loan, you’ll benefit from this regardless if the price of the property increases or not.

The final way to make money in real estate is through:

Tax Benefits

ALWAYS Consult a Tax Professional

I’m just a dude on the internet with some experience in real estate giving you information & education, not financial advice.

You can write off any expense required to obtain the loan or operate the property. However, there are rules as to what can be deducted immediately versus what must be deducted over time (i.e., depreciated) [3].

You can immediately write off things like:

- Routine repairs & maintenance

- Operating expenses such as utilities, property fees, gardening etc.

But you’ll have to depreciate things like:

- Points & other closing costs

- Capital Expenditures such as a new roof, redoing plumbing or electrical, HVAC & room additions.

The items mentioned above are small potatoes. The huge financial wealth generating opportunity comes when you get to write off a portion of the value of the entire house!

Depreciation

PROVIDED YOU’RE TREATING IT AS AN INVESTMENT & RENTING IT OUT, the IRS allows you to treat a property as an asset that loses value over time.[3]

You can deduct that loss of value in equal amounts over 27.5 years for a residential property.

You benefit from depreciation because it’s a non-cash expense that reduces your taxable income & shelters some of your cash flow from taxes.

For example, if the building portion of the property is assessed at $250k, you can write off $9k/yr. (250k/27.5 years). If you receive $18k/yr. in rent which costs you $5k/yr. in operating expenses, most people think you owe taxes on the remaining $13k.

That’s not true.

You get to deduction the $9k for depreciation. This leaves you only $4k to pay taxes on. As a bonus, If the depreciation amount exceeds the rental income of the property, you can use this excess amount to shelter other income or profits not related to the property (i.e., Stock or other investment gains, income tax etc.).

Depreciation Recapture & the 1031 Exchange

It’s nice to get the tax benefits upfront. But the IRS doesn’t just give money away. You’ll have to pay a portion of that back once you sell. This is known as depreciation recapture.[5] You’ll have to pay up to a max of 25% on the cumulative depreciation you claimed.[4]

For Example, if you hold the property for 10 years & claim $9k/yr. in depreciation, you will have to pay taxes on that $90k once you sell the property. The tax rate is based on your then current tax rate, up to a max of 25%. In this example, that would be $23k!

There are 3 ways to avoid this recapture of depreciation:

- 1031 exchange [6]

- Die!

- Sell at a loss to your adjusted basis

The last 2 options are not desirable so that only leaves the 1031 exchange.

With a 1031 exchange, you use the proceeds from the sale of one property as the down payment on another, usually larger, property. You can keep rolling over your profits from any property and NEVER have to pay taxes on it!

We’re not going to go in depth into the 1031 exchange, but I suggest you understand it if you want to invest in physical real estate.

So that concludes this discussion on the 5 ways to make money, but they’re not the only reasons to invest in residential real estate.

Common wisdom claims that residential real estate is a good inflation hedge & portfolio diversifier. If you’ve ever wondered if those claims are true, check on my articles on real estate and inflation protection, & whether residential real estate is an effective diversifier of a stock portfolio.

- S&P/ Case-Shiller U.S. National Home Price Index (CSUSHPINSA). https://fred.stlouisfed.org/series/CSUSHPINSA . Accessed 8/26/2022

- Yahoo Finance. https://finance.yahoo.com/quote/%5EGSPC/history?p=%5EGSPC Accessed 8/26/2022

- Internal Revenue Service. “Tips on Rental Real Estate Income, Deductions and Recordkeeping.” https://www.irs.gov/businesses/small-businesses-self-employed/tips-on-rental-real-estate-income-deductions-and-recordkeeping . Accessed 8/26/2022

- Internal Revenue Service. "Topic No. 409 Capital Gains and Losses." https://www.irs.gov/taxtopics/tc409 Accessed 8/26/2022

- Internal Revenue Service. "Publication 544 Sales and Other Dispositions of Assets for Use in 2021 Returns.” https://www.irs.gov/pub/irs-pdf/p544.pdf Accessed 8/26/2022

- Internal Revenue Service. “Like-Kind Exchanges under IRC Section 1031”. https://www.irs.gov/pub/irs-news/fs-08-18.pdf Accessed 8/26/2022

Get Our Latest Delivered To Your Inbox

You will receive 1-2 emails per month and you can unsubscribe at anytime