Over the past 9 months, the US inflation rate has taken off. Millions of people are scrambling to figure out how they’re going to manage higher prices. The CPI & PCE are running in the 5-7% range while the PPI is out of this world at 10-20%. As explained in “Common Measures of Inflation,” the 2nd part of this 5-part series, the PPI measures changes of input prices throughout the supply chain.

Over the past 20 years, spikes in the PPI have not translated to spikes in the CPI or PCE. However, it is possible that the CPI & PCE follow the PPI into the 10%+ range. The highest since the 1970’s & 80’s.

Summary

- 6%+ Inflation is not necessarily a problem in and of it’s self.

- Quantitative Easing has created bubbles in the bond, stock & housing markets.

- Other than a debt jubilee or a monetary reset, the Fed has 2 options:

- Raise interest rates to fight inflation – This would crash the economy.

- Cap interest rates and let savers and consumers pay the price – This is the option they have chosen time & time again.

- Is inflation permanent or transitory?

- Both! – We must differentiate between price levels and rate of change of price levels.

- Some prices will fall back to what they were before, but most of what has already happened is permanent (i.e., not transitory).

- The transitory part has to do with the rate of change.

- Although we may have to deal with 6%+ inflation for longer than we’d like, I expect the rate of change to fall somewhat due to enormous debt loads, technological progress, an ageing population, falling birth rates and stagnant real wages.

- However, there are 3 things that I believe have moved us to a higher baseline growth rate for the foreseeable future

- Supply chain issues

- ESG mandates

- The growing prevalence of government payments to consumers

- Both! – We must differentiate between price levels and rate of change of price levels.

- Is inflation permanent or transitory?

Is Inflation a Problem Today?

If the CPI were an accurate measure of inflation my answer would be no. We’ve seen annual inflation rates over 6% several times since 1900. We had such periods during both world wars, back in the mid 70’s, early 80’s and early 90’s.

But we’re in a much different situation than we have been in the past for several reasons. First, as I argued in “Inflation Manipulation: Problems with the CPI & PCE,” The CPI understates the true inflation rate. Second, debt of all sectors is at all-time highs. Third, historically low interest rates are crushing savers. Fourth, the stock, bond and real estate markets are at all-time highs. Everything is a bubble and inflation appears to be taking off or at least staying elevated for the foreseeable future.

Given the predicament we’re in, the fed has two options:

While official inflation measurements are running in the 5-7% range, Shadowstats.com has continued to track inflation based on the 1980’s & 1990’s definition of CPI which includes house prices, removes HQAs and maintains a fixed basket of goods and services. Those metrics put consumer inflation in the 9-13% range already.

Increase interest rates to fight inflation

The Fed cannot allow interest rates to rise enough to fight inflation.

Those holding bonds at 1-1.5% would get kicked in the teeth. Stockholders would as well for two reasons. First, the risk-reward dynamics would favor a reallocation into bonds. Second, higher interest rates would reduce corporate profits due to higher financing costs of their all-time high debt loads. Then there is the real estate market. Prices at all-time highs are already severely out of sync with incomes. Higher interest rates will result in an affordability crisis. Buyers would flee the market and prices would come crashing down.

There’s only one option that doesn’t involve debt forgiveness or a new monetary scheme.

Cap interest rates & pray that inflation doesn't get out of control

For all the reasons mentioned above, the Fed will continue to cap rates. This will lead to wealth extraction from savers through negative real interest rates while the Fed prays that inflation doesn’t get out of control.

That’s their playbook. They did it after both world wars when debt levels got too high, and we had a few years of negative real rates in the 70’s and 80’s. In fact, if you agree that the CPI and PCE understate inflation, then we’ve had negative real rates off and on for the past 15 years.

The success of this approach depends on 6%+ inflation being temporary.

is the current inflation rate transitory or permanent?

The disagreement, confusion, and sleight of hand in the debate over the transitory nature of the current US inflation rate has to do with this difference between index levels and rates of change. We talked about it in “Common Measures of Inflation,” the second part of this series on inflation. Go back and check it out if you don’t remember the difference.

On one side, the Federal Reserve is claiming that the current inflation rate is transitory. Many economists, consumers and corporations disagree. They argue that this rise in prices will be permanent.

Ironically, both can be correct, and in my opinion, likely are. You just need to understand that Jerome Powell is talking about the inflation rate of change, while everyone else is talking about the actual price level.

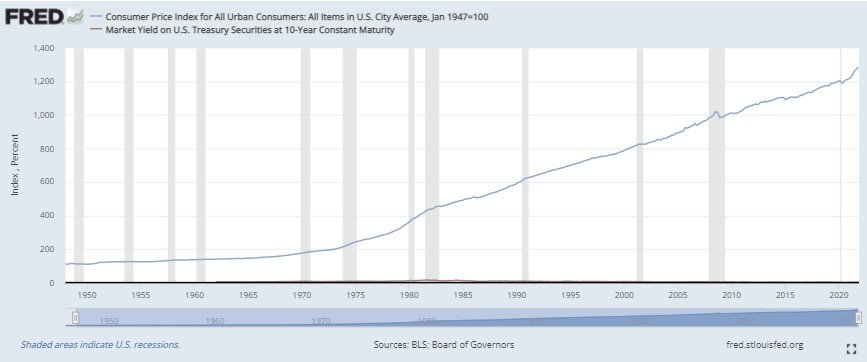

On one hand, you have inflation which means that prices are going up. The index is sloped upwards. The rate of change is positive. We almost always have inflation. Just look at the CP-lie errr CPI indexed chart.

Much of the current price increases in items such as food, clothes, and many services, are likely permanent. Their prices probably won’t return to levels seen before the pandemic unless we have a deflationary event.

On the other hand, we are seeing accelerating rates of inflation (i.e., the rate of change in the inflation rate is increasing). This is the transitory part, according to the Fed.

In order for the rate of change not to be transitory, we would need to see the inflation rate stay above the 6% level and not come back down for quite some time.

The rate of change may in fact increase like this over the next 1-2 years but there will be a point in time where the rate of change levels off and starts falling. This is what Jerome Powell is talking about when he says inflation is transitory.

And I agree with him to an extent. The influence of enormous debt loads, technological progress, an ageing population, falling population growth rates, and stagnant real wages, points to economic stagnation and lower inflation.

However, there are three things that I believe have moved inflation to a permanently higher baseline rate of growth.

Supply chain Issues

This is the transitory part. Once we work through this, the inflation rate should fall from current levels. As long as it remains a problem, prices will remain elevated.

ESG Mandates

The push away from fossil fuels without a dependable alternative in place is necessarily going to cause higher energy prices over at least the next decade.

The Growing Prevalence of government payments to consumers

Even a moron can tell you that if you give consumers money without tying it to some sort of production1, you are going to get inflation. If you don’t understand why, we discuss supply push and monetary inflation in “What is Inflation.”

What I don’t like is how Powell is using the word transitory to get the public to jump to conclusions. The conclusion that 6%+ inflation will only last a few months and then prices will fall back to what they were. I have not heard anyone at the Federal Reserve claim that the recent price increases were temporary. Rather, they expect the high rate of change to be temporary. They do not expect prices to fall back to what they were before. In fact, if we did get deflation, the Fed and Treasury would once again increase the money supply.

The public wouldn’t be fooled if they understood the difference between index levels and rates of change.

Unfortunately, you will have to pay permanently higher prices for many items. However, I believe the rate of increase will fall back for most things.

Although higher prices are here to stay for many goods and services, there are tons of ways to protect yourself from inflation. I will discuss 30 ways to do so in the final piece of this 5-part series on inflation.

1 Every US city testing free money programs. By Chose DiBenedetto. Mashable.com. https://mashable.com/article/cities-with-universal-basic-income-guaranteed-income-programs Accessed 10/31/2021

Get Our Latest Delivered To Your Inbox

You will receive 1-2 emails per month and you can unsubscribe at anytime