When it comes to portfolios, my personal advice is for anyone who can, put money into forestry or farmland. Long term, you would probably never come near their returns in the stock market. In the world that I see, land is golden.

- Jeremy Grantham Tweet

Each day seems to bring increasing uncertainty & challenges for the storage & growth of our financial wealth.

Central Bank policy is resulting in reduced liquidity in most of the major financial markets around the world. Supply chain constraints & soaring inflation are wreaking havoc on corporate & household finances. And the potential for world war is adding fuel to the fire.

This uncertainty, & a general over exposure to traditional assets, leads investors to look for other ways to store their financial wealth. They often explore alternative investments in hopes that they can find something that

- Consistently appreciates in value & beats inflation

- Produces a cash flow

- Diversifies your portfolio & protects during downturns

- Is intrinsically valuable

Summary

- There are 6 ways to make money investing in farmland:

- Renting farmland (AKA Cashflow)

- Market-Based Price Appreciation

- Forced Price Appreciation

- Tax Benefits

- Subsidies

- Investing in farmland is a great way to diversify a traditional portfolio

- Farmland provides good returns with lower volatility than most other assets

- Farmland has demonstrated resilience during recessions & downturns in the stock market, as well as during inflationary periods

- Farmland exhibits very low, & sometimes negative, correlation to stocks & bonds

- Unfortunately, it’s horrible at guarding against traceability or seizure

- Investing in & renting farmland comes with many risks with the most important being

- Illiquidity

- Vacancy

- Large upfront costs

- Operational risk

- Interest rate risk

- Government/Political policies

- Physical farmland comes with the challenge of keeping your allocation to this asset within a reasonable range

- The 2 main ways around this are:

- Crowdfunded investment platforms

- Real estate investment trusts (REITs)

- The 2 main ways around this are:

In this article, we will answer the question, is farmland a good investment? We’ll discuss how you make money renting farmland, how it does versus inflation, & it’s performance during down markets. We’ll then go on to explore the risks & some considerations for addressing the challenges of adding it to your portfolio.

Let’s start off with the case for farmland investing.

The Potential for Higher Returns

Farmland investing is unlike many other investments because there are 6 ways to make money, and lots of it, if you do your research.

The first way to make money is through cash flow.

Renting Farmland (aka Cash Flow)

This is the difference between money coming in from renting farmland & money going out to operate, maintain, & pay the mortgage.

Think of it like a checking account. Money flows in, money flows out.

But money comes in only if you rent the land out or produce something that can be converted to cash. If the land sits idle, you’ll only have money going out. In other words, you’ll have a negative cash flow that you’ll have to cover out of your own pocket.

I’m not sure about you but I don’t want to have to keep taking from my own pocket to hold an investment. I want that investment to pay me instead.

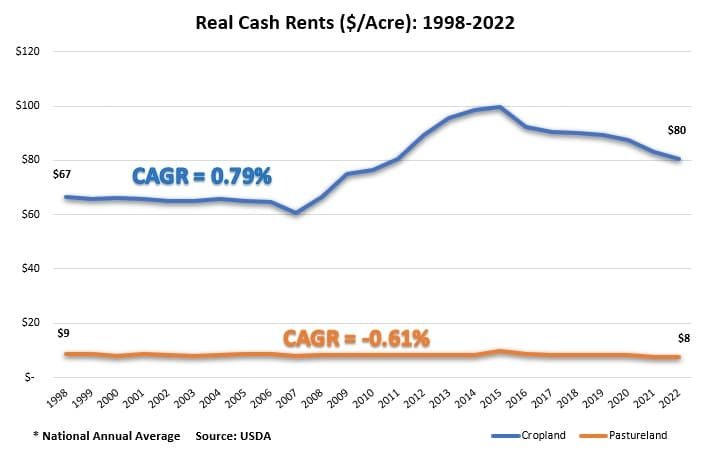

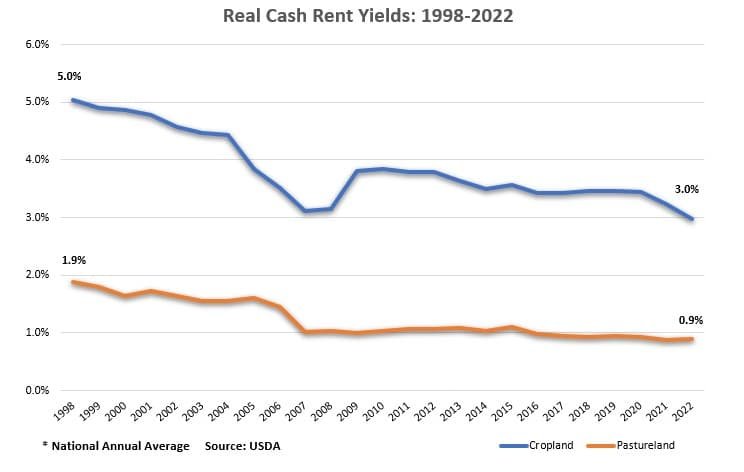

Unfortunately, the current yield (the rent per acre as a % of the farmland value) sits at 3% for cropland & a paltry 0.9% for pastureland.[1]

This begs the question, why would you want to invest in farmland when the 1-year treasury yields 4%+? Keep this in mind as we explore all the risks, opportunities & allocation considerations that come with farmland investing.

Cash flow is good because it creates a baseline return on your investment & the money can be used for whatever you want. You can

- Use it to deal with the impact of inflation by using some of it for living expenses.

- Invest it in other assets with the goal of building a well-diversified portfolio.

- Use the cash flow from an existing property to finance the acquisition of the next one.

In my opinion, option 3 is the smartest use of the funds provided each property generates a positive cash flow. Stack cash flows like that for several properties & you can build a meaningful 2nd income stream to help you on your quest for financial freedom.

Furthermore, rents tend to increase faster than inflation over time, further increasing your purchasing power over time. [1]

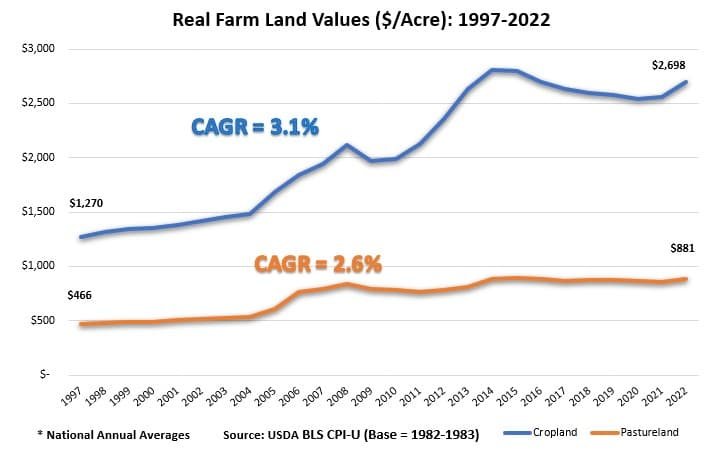

When investing in farmland, it’s important to distinguish between cropland & pastureland because the rates of return can be quite different.

Cropland rent growth has tended to outpace inflation by 0.79% over the past 24 years. On the other hand, pastureland rents trailed inflation over the same period. [1]

In addition to cash flow by renting farmland, you also have the option to sell the produce of the land. You can do it yourself or partner with a farmer by crop sharing. This can absolutely increase your returns. However, it’s my opinion that newbies should hold off until they know what they’re doing.

First, you will have to pay for all or a portion of the operating expenses such as fertilizer, seeds, water, etc. Even worse, these costs tend to increase over time.

Second, inflation adjusted prices of major crops & livestock have trended down over the past 30-50 years.[2]

In fact, only oats have kept up with inflation while cotton has trailed inflation by 2.3% per year! [2]

If the inflation adjusted prices of the produce you’re selling constantly decrease, while your costs constantly increase, you’re starting off in a horrible position.

The pressure is on to constantly increase the productivity of your operations. Otherwise, your returns will shrink overtime, and could even lead to losses. Because of this, it’s my opinion that newbies should stick to renting farmland rather than getting involved with crop sharing.

The next source of farmland investment returns is through equity.

Building Equity with Farmland

Equity is simply the difference between the price you can sell a property for & what you still owe on it. Whereas cash flow is your checking account, think of equity as your savings account.

Just like with real estate, you have 3 components of equity: market-based price appreciation, forced price appreciation, & loan paydown.

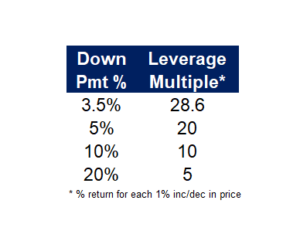

This is a significant driver of financial wealth because you’re able to get so much leverage with a mortgage.

This chart shows what is called the leverage multiple. Depending on what % you put down, you get a disproportionate increase in your return on investment.

A 1% increase in price can result in 5% – 28.6% return on your investment. This is why land & real estate have played such a large role in the building of so many fortunes. You’re dealing with large dollar amounts and you can get tons of leverage to amplify your returns.

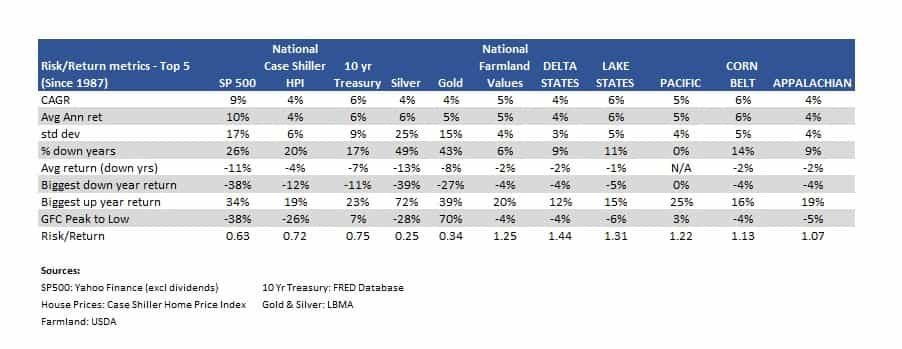

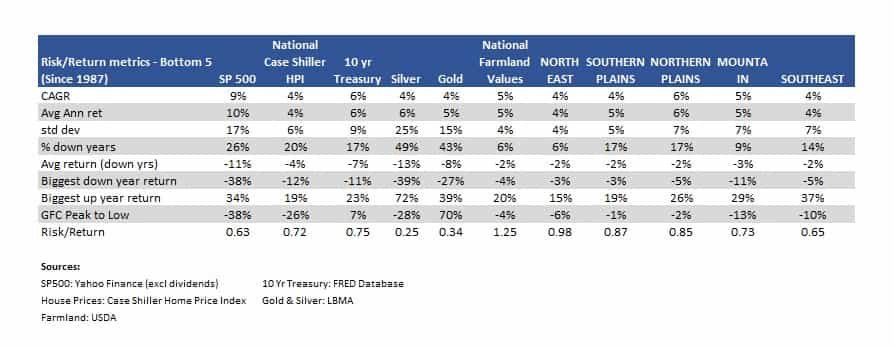

Based off the USDA’s farmland values since 1987, you’re looking at a 4-6% nominal return. [1] There are a few things that differentiate the top performing markets from the lower performing markets. First is the higher price variability of the lower performing markets. Second is the larger magnitude of decreases in land values during down years in the lower performing markets.

Compare that to the 9% return of the S&P 500 over the same period. This is why I say stocks are the best wealth builder for the average person.

This is where you improve the land & watch the farmland value & rent increase by more than what you spent on improvements. Examples include soil improvement, improving access to the land, improving drainage, adding a backup water source & more.

You have two options here:

- You pay the mortgage down.

- Rent the property out & your tenants pay the mortgage down for you, but you reap the benefits of increasing equity.

Which one sounds better to you? This is why renting farmland makes so much sense. Provided you don’t default on the loan, you’ll benefit regardless of what happens to the price.

The next source of returns comes in the form of tax benefits.

Farmland Tax Benefits

There are 3 main tax benefits afforded farmland.

ALWAYS Consult a Tax Professional

I’m just a dude on the internet giving you information & education, not financial or Tax advice. I am not a licensed tax professional. All tax related topics should be discussed with a qualified tax professional.

You can immediately write off any expense required to obtain the loan or operate the property. This includes routine repairs & maintenance, purchase of supplies, labor etc.[3]

Unfortunately, you can’t immediately deduct big ticket items like equipment, machinery, or the addition of a building to the land. These are considered capital expenditures & must be depreciated over time. [3]

The IRS allows you to treat capital goods used to operate the farm as investments that lose value over time.

THE FARM MUST BE CONSIDERED “IN SERVICE” & actually producing something before you can claim a depreciation deduction. [3]

And you can only depreciate capital goods such as machinery, equipment & buildings. You cannot depreciate land. [4]

Capital investments can often be depreciated at much quicker rates than real estate. You’re looking at 5-20 years, depending on what is being depreciated, versus 27.5 years for residential real estate. [3]

You benefit from depreciation because it’s a non-cash expense that reduces your taxable income & shelters some of your cash flow from taxes. For example, if the building portion of the property you bought is assessed at $250k, & assuming you can depreciate it over 20 years, you can write off $12,500/yr.

Let’s say you receive $25k/yr. in rent & pay $10k/yr. in operating expenses. Most people think you must pay taxes on the remaining $15k. That’s not true. You only have to pay taxes on the remaining $2,500 after the depreciation deduction.

So, you get the tax benefits upfront. But the IRS doesn’t just give money away.

Under the IRS rules of depreciation recapture, you will have to pay a portion of that back once you sell. [5]

For example, say you hold the property for 10 years. Claiming $12,500/yr. in depreciation results in a cumulative depreciation claim of $125k. You will have to pay taxes on that $125k, based on your then current tax rate, up to a max of 25%. At 25% that would be $31k!

However, there are 3 ways to avoid this recapture of depreciation

- 1031 exchange

- Die!

- Sell at a loss to your adjusted basis

The last 2 options are not desirable so that only leaves the 1031 exchange.

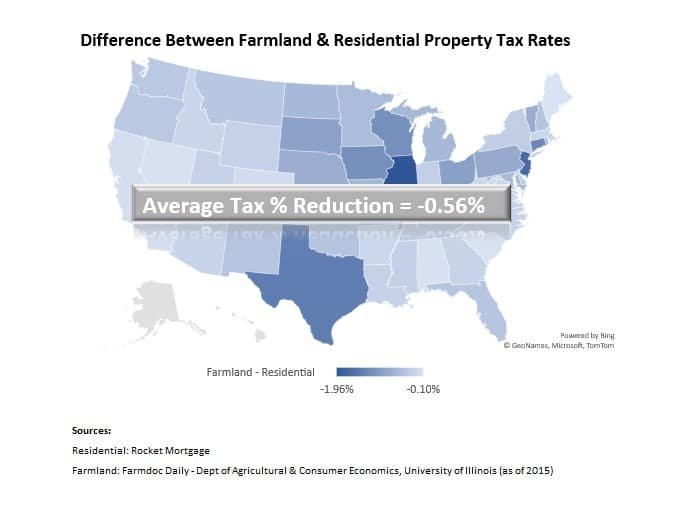

Every single state offers lower property tax rates on farmland versus residential real estate. The average reduction is 0.56% of the property value.[6]

The largest reductions come in Illinois, New Jersey, Texas, Wisconsin & Iowa. The lowest reductions come in Maine, Alabama, S Carolina, Nevada & California.

On a $300k property, that’s a savings of approx. $1,700/yr.

Now, unlike residential real estate, farmland investing comes with the additional money-making opportunity of subsidies.

Farmland Subsidies

There are 4 primary forms of subsidies.[7]

The first two apply only if you will be growing crops on the land. If you are just renting farmland out, only the 3rd & 4th will be available to you.

These are a series of government programs designed to ensure farmers receive a certain price or level of revenue for their operations.

Let’s say the government declares that a bushel of wheat should be $3/bushel & the market price drops to $2/bushel. The government will pay a $1/bushel subsidy to ensure that farmers get the $3/bushel rate.

Target prices vary by crop.

The USDA pays farmers when their crop yields or revenues decline due to things such as:

- Drought

- Excessive rain

- Freeze

- Decline in price

And more.

Just like any other insurance, farmers pay a premium for crop insurance. But there is a huge benefit here. Premiums are approx. 60% subsidized meaning farmers only pay about 40% of the premium.

Here the USDA pays an annual rental payment in exchange for removing environmentally sensitive land from agricultural production & planting species that will improve environmental quality.

The Government reimburses farmers for the loss of production or income due to natural disasters.

So, those are the primary ways to make money investing in & renting farmland. But that’s not the only benefit.

I frequently hear that farmland is a good inflation hedge…. but is that true?

Farmland as an Inflation Hedge

When determining whether farmland is an effective inflation hedge, you must consider two scenarios. First, can it maintain your purchasing power over the long term? Second, how does it do during short term spikes in inflation?

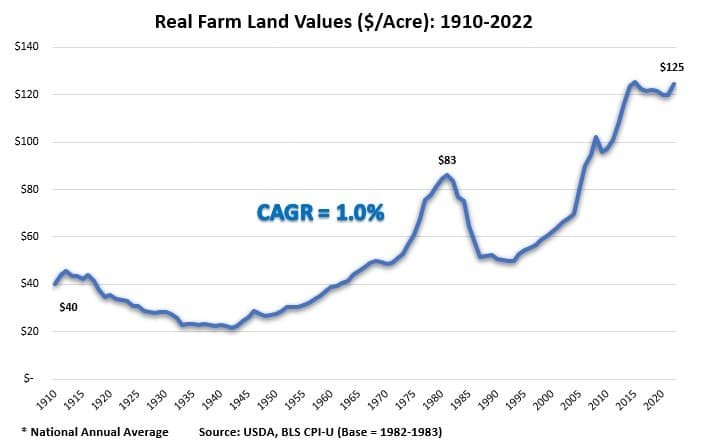

Farmland beats inflation by 1% per year over the past 110 years. [1] This may not sound like much but it’s enough to have tripled your ability to afford goods & services over that time frame.

Please note that this shows historical farmland values on a national level. It’s also combines cropland with pastureland because we don’t have data that splits between the two land types going back further than 1997. Since 1997 though, you’ll see that both have done very well versus inflation with cropland outperforming pastureland over the past 25 years by 0.5%/yr. [1]

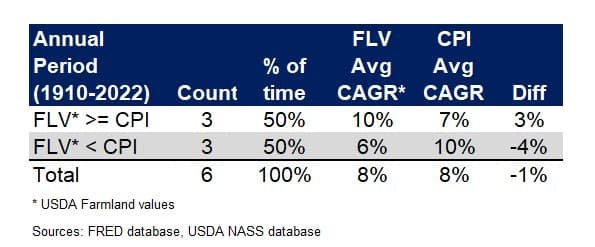

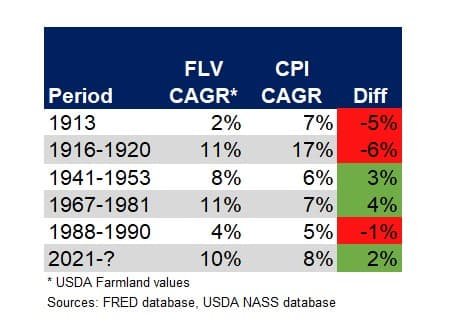

During short-term inflation spikes the results are more mixed. I define an inflation spike as a CPI value of 5% of more.

There are 6 such periods since 1910. Farmland has beat inflation in half of those periods by an average of 2.9%. It has underperformed inflation in the other half of such periods by an average of -4.1%.[1]

Having said that, most of the underperformance versus inflation occurred early in the 1900’s. Farmland’s inflation hedging track record is overwhelmingly positive since the 1940’s.

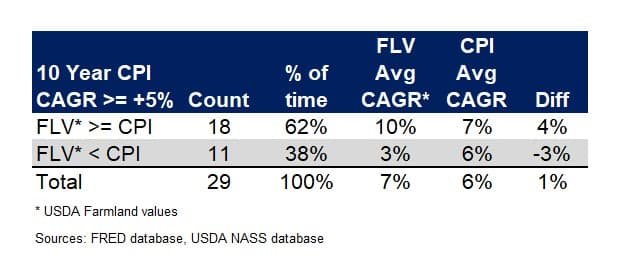

I also looked at the 10-year compounded annual growth rates of farmland values vs the CPI.

Of the 29 rolling 10-year periods with an avg annual CPI of 5% or higher, national farmland values trailed the CPI 38% of the time by an average of -3.2%. They beat the CPI 62% of the time by an average of 3.7%.[1]

To sum all this up, farmland values tend to hold up against inflation during short spikes in the CPI. Better yet, over periods of 10 years or more, a farmland investment handily outperforms inflation by an average of 1%/yr. [1]

Additionally, this analysis only focuses on price movements. If you factor in the other sources of returns covered earlier, farmland easily beats inflation.

The 3rd reason you’d want to invest in farmland is for diversification.

Farmland for Diversification

To evaluate the ability of farmland to effectively diversify your portfolio, I focus on 4 main things:

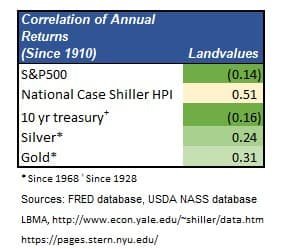

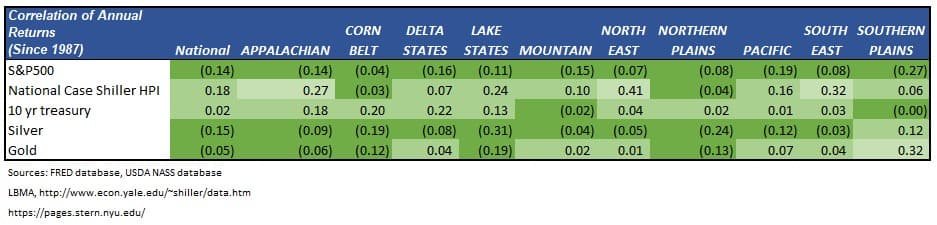

First, the correlation of annual farmland investment returns to other commonly held assets is very low since 1910. In fact, it’s negatively correlated to stocks & bonds.

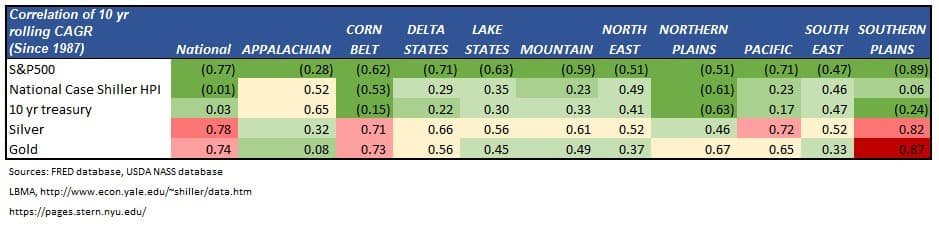

Not only do the low & inverse correlations hold at the national level, they hold at the geographical level as well.

NOTE: Geographical correlations are since 1987 not 1910. This is as far back as the data goes at the geographic level.

It’s great to see the low & inverse correlations of historical farmland returns. However, real estate markets move much slower than traditional asset markets. This means annual returns may not be the best timeframe to view farmland investment correlations.

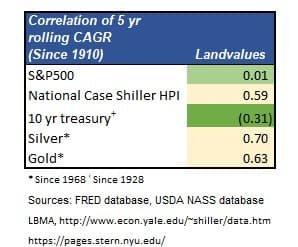

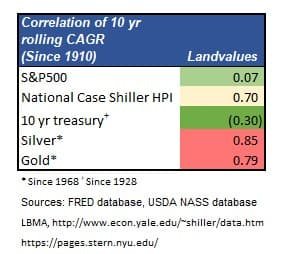

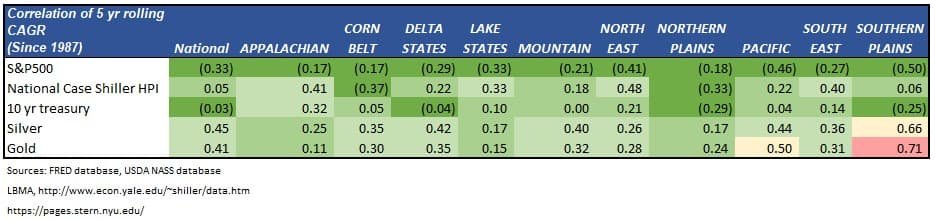

Because of this, I looked at the correlation of the 5yr & 10yr rolling returns. Although I found pretty much the same thing, a bifurcation between assets started to appear. The correlation of farmland investment returns with stocks, bonds & residential real estate remained about the same. But an unexpectedly large correlation between farmland & gold & silver popped up. Not only over 5 years, but it got even higher over the 10-year periods as well.

And not only is this the case as the national level, but it also holds for most geographical regions too. The Southern Plains, which consists of Texas & Oklahoma, are very highly correlated with gold & silver.

All in all, this shows that there are sufficiently low correlations between all regions & these traditional assets that it satisfies the objective of low correlation for most people.

I say for most people because most ordinary people do not hold large quantities of gold or silver. They hold stocks, bonds, & many hold real estate.

Of course, if you hold residential real estate, it’s likely that it makes up a large % of your total net worth.

Because of this, you should be aware of the fairly high correlation with farmland investment returns. It might make sense to find another investment if you’re worried about that. But for those who hold primarily stocks & bonds, farmland appears to be a great non correlated, & in some cases, inversely correlated asset to add to your portfolio.

So, we’ve established a low correlation to traditional assets, but what about the returns?

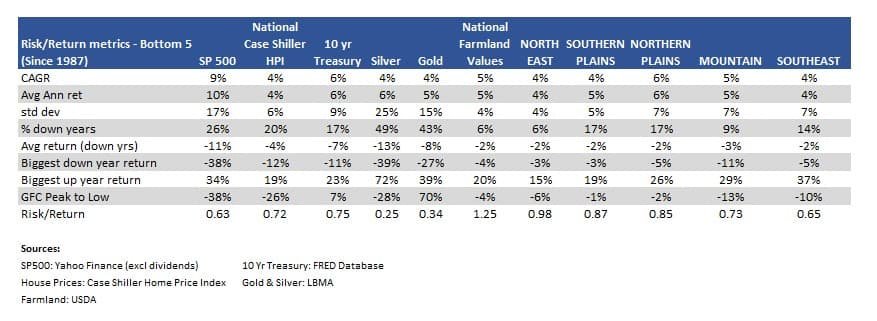

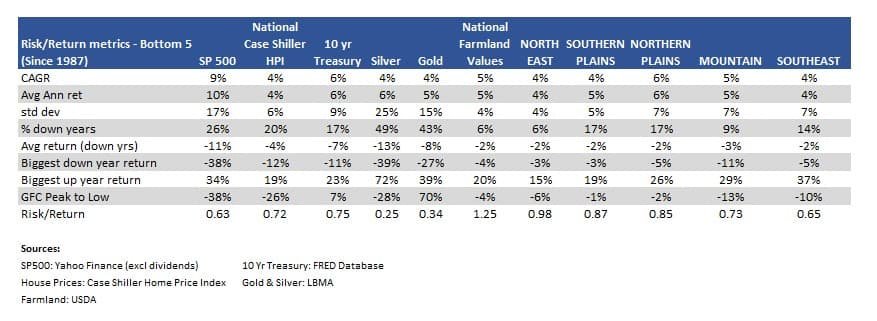

At the national level, it’s obvious that a farmland investment will improve the risk/return profile of your portfolio.

Farmland blows stocks, bonds, residential real estate, gold & silver out of the water! The avg return per unit of “risk” is higher. It has a lower % of down years. It also loses less during its down years compared to these other assets. Although it’s biggest up year return is lower than many of these other assets, it’s about the same as residential real estate.

Additionally, it dropped only 4% during the GFC. This is much, much better than the 25-40% drops in these other assets during that time. The same holds true at the regional level.

First, we have the best markets in terms of risk/reward. Every region blows stocks, bonds, residential real estate & precious metals out of the water.

Then You have the worst performing regions.

Even these returns compare favorably to these more traditional assets. Only the Mountain & Southeast regions fail to beat the risk adjusted returns of ALL these other assets. Having said that, these two markets still offer a better risk/reward proposition than stocks, gold & silver. This is due entirely to their lower price variability.

Remember though, this only factors in price returns. It ignores cash flow from renting farmland, loan paydown, & tax & subsidy benefits. Once you factor those in, the total return will be a % point or two higher than what is shown in these grids. This clearly demonstrates that investing in farmland will not reduce expected returns when added to a traditional portfolio.

We can now conclude that investing in farmland will reduce portfolio volatility without reducing expected returns.

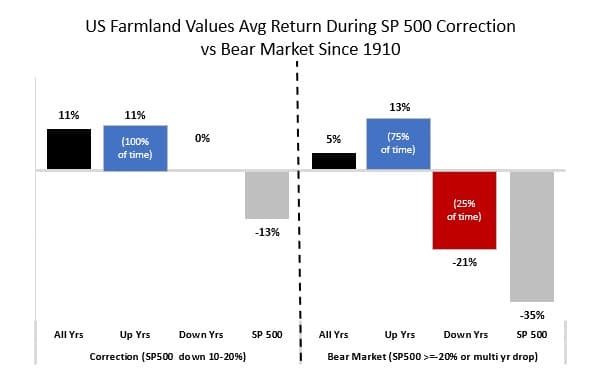

I went back & looked at the behavior of farmland on a national level during stock market corrections & full-on bear markets since 1910.

I define a correction to be a drop in stocks of 10-20%. I define a bear market as a drop in stocks of 20% or more, or a multi-year drop.

As you can see in this chart, it holds up very well during both corrections & bear markets. Even better than residential real estate.

During corrections, farmland values increase 11% on average & have never dropped during a correction lasting 1 year or less. Said differently, when stocks drop 10-20%, farmland values are up 100% of the time since 1910 & returns an average of 11%.

During bear markets on the other hand, farmland values have dropped a couple of times but for the most part, they’re up.

When farmland values do drop, they drop 21% on average while stocks drop 35%. This is a bit misleading though. Out of the 8 stock bear markets since 1910, farmland values have dropped only twice. One of which occurred during the great depression where it dropped by 39%. The only other time it dropped during a bear market was in the 1940’s. It only dropped 3% while stocks dropped 34%. In the 6 other stock bear markets, farmland values were up 13% on average, while stocks dropped 32%.

There seems to be an increase in the censorship of opinions that differ from the official narrative. [9] Also, the state is increasingly targeting its own citizens.[8] This makes it more & more important that we hold assets that can’t be traced back to us or are highly resistant to seizure.

Unfortunately, farmland fails miserably in this area.

It’s a large physical asset & you must tie yourself to the property to establish ownership. This exposes you to the possibility that a claim or judgement be placed on the property by the state. There would be little you can do to stop the state from taking the property.

For the same reason, it’s pretty much impossible to discretely pass it onto your heirs so that they don’t have to pay taxes.

The combination of low historical correlations with the fact that farmland values hold up very well during stock market corrections & bear markets, leads to my conclusion that farmland indeed acts as a powerful diversifier in a portfolio.

Another fact that supports this conclusion is that out of 16 times that stocks dropped 10% or more, farmland values NEVER dropped more than stocks.

However, there have been several instances of farmland values dropping while stocks have increased. Again, pointing to the low & occasional inverse correlation between stocks & farmland since 1910.

The 4th and final reason for investing in farmland is because it has massive amounts of intrinsic value.

The Intrinsic Value of Farmland

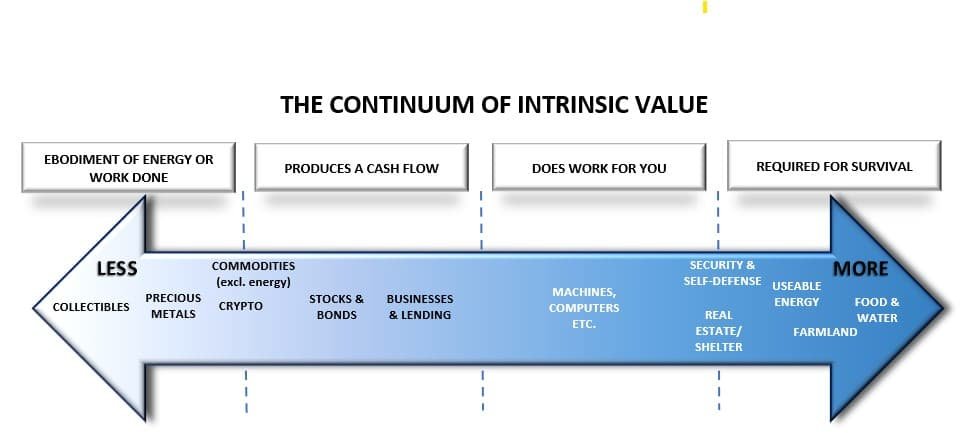

I’m talking about real intrinsic value, not what I consider to be fake intrinsic value like precious metals, diamonds, or watches.

In my opinion, intrinsic value exists on a spectrum ranging from being able to help you survive, to being able to do work for you or producing a cash flow, all the way down to the embodiment of the energy required to produce it, which is pretty much everything.

A farmland investment has several aspects of intrinsic value with the most important being:

- You can use the land to produce food & other materials needed for survival

This is one of the qualities of farmland that really sets it apart from any other investment. Only a couple other investments can give you one of the inputs (productive soil) specifically designed to feed yourself & your family in the case of food shortages.

- You can build a structure on it that can protect you to a large extent from the environment around you

- It can Produce a cash flow

- It can be an embodiment of nature’s microbiome that can be integrated with the natural environment around it

Because of these very valuable aspects of true intrinsic value, there will ALWAYS be a demand for farmland provided US citizens don’t lose their mind and agree to eat bugs or lab created food.

There aren’t many assets that can guarantee a demand for it regardless of the scenario.

Now we know about the reasons you’d want to look at investing in farmland. Let’s turn our attention to the risks or drawbacks of investing in farmland.

The Risks of Investing in Farmland

Every single investment comes with risk. There is no risk-free asset as many like to claim for US treasuries.

To improve the probability of a profitable farmland investment, it’s vital that you understand all the risks. But that’s not enough. You need to take steps to reduce those risks, if possible.

Some risks you’ll face while investing in farmland include:

Just like residential & commercial real estate, the location is a huge factor when it comes to farmland.

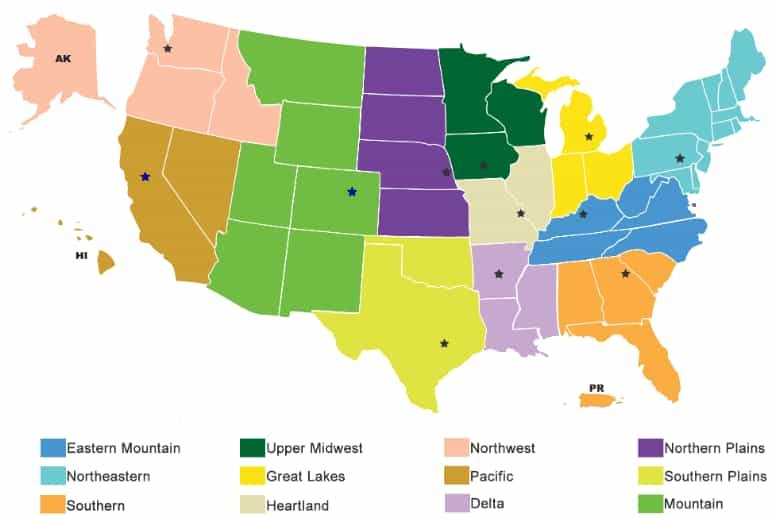

The USDA breaks the US into 12 regions. Each of which has different soil types & qualities, weather, government regulations & more.

For example, western regions are going to be more susceptible to drought. Eastern regions will be more susceptible to flooding & freezing. As a result, each region will have different supply/demand dynamics & risk/return profiles.

Let’s circle back to the risk/return tables we discussed earlier. You have regions like the delta states, lake states & the pacific which have historically offered steady, stable returns with low price variability.

Compare that to regions like the southeast or mountain regions which have shown higher price variability and risk of large price drops.

Just like any land or real estate investment, it takes quite a while to buy & sell. It will take 2-3 months minimum. Often it takes a year or more due to the unique characteristics of each plot of land.

Because many farm operations require highly specific qualities (weather, soil quality, topography for drainage etc.) to produce their crop or livestock, finding a buyer can be a tedious task.

It’s now possible to invest in farmland via crowdfunding sites like AcreTrader, Farmfundr & Farmfolio. The problem is that almost all these funds require a 5-10 year holding period. Very few offer a secondary market to sell into. Even if they do, you are restricted to selling on that one platform. This significantly reduces the number of buyers you have to sell to.

There is one form of farmland investing that solves this illiquidity problem. We will discuss it later in this article.

A result of this illiquidity is that it becomes more difficult to value prior to putting it on the market.

There is a ton of data out there from the USDA & other farm related organizations. This can help you get a good idea of an aggregated average value per acre of farmland.

The problem is that each farm’s unique productive capacity characteristics (the soil’s moisture retention, micronutrients, the climate & historical production capabilities) significantly influence the true underlying value of the land.

These variables often go untracked & unreported. This means they’re not fully considered in the valuation of a plot of farmland until a potential buyer assesses your land or you pay for an assessment yourself.

There are many loan programs, like through the FSA, where you don’t have to put more than 5% down. However, closing costs tend to be around 3%.

This means you’re usually looking at a minimum of 8% of the purchase price to buy farmland. Assuming $200k-300k purchase price, that’s $8-16k out of pocket.

That’s cheaper than the upfront costs to get into a residential or commercial property. But most ordinary people don’t have $8-16k available for investing in farmland.

This is pretty much a certainty in land & real estate investing. No matter what you do, it’s pretty much guaranteed that you will have a period where nobody is renting your property.

This leaves you on the hook for the mortgage payments over that period. Because this means lost revenue, it’s vital that you account for vacancy in any calculations when considering a farmland investment.

Talk to a real estate agent or property manager in the area you plan to invest for estimated vacancy rates. Make sure they are experienced in dealing with farmland.

The best ways to minimize vacancies are

- Charge a competitive rent

- Have a good tenant screening processes in place

- Know the amenities that are desired by farmers in your area

- Keep the property, soil, buildings, fencing etc. in good shape

- Develop & maintain a network of potential renters, agents & property managers

- Advertise

The demand for renting farmland is directly influenced by the profitability of farmers looking to rent your land.

As profitability falls, the farmer has two choices. Find more and more ways to increase the productivity of their operations &/or get more subsidies.

Farmland profitability has fallen on an inflation adjusted basis for decades now. This is due to rising energy, fertilizer, equipment & labor costs, coupled with falling crop and livestock prices.

Either way, there is a risk that one or both of those avenues get reduced over time. This will reduce the desirability of buying of renting farmland.

Higher interest rates increase the costs of acquiring farmland unless you pay cash.

The landowner must charge a higher rent to maintain the same level of cash flow. The alternative is a lower return on investment.

Higher borrowing costs can also increase the cost of operating a farm. The higher the use of heavy machinery & other debt financed inputs, the more of an impact higher interest rates will have.

This takes us back to the operational risk that we just discussed. Borrowing costs are a cost of doing business. If costs go up, the farmer has two choices to keep the same level of profitability. Find ways to be more productive or get more subsidies. If they are unable to do so, the demand for buying or renting farmland will drop over time.

Additionally, when borrowing costs are low, it’s profitable to borrow against your existing holdings to finance additional properties. Once interest rates rise, that becomes less feasible. This puts downward pressure on farmland values as the demand for credit decreases.

Higher interest rates also affect the risk/return considerations for other investments. If you can get an acceptable interest rate by just parking your cash in a CD or treasury, many people will decide to do that instead of dealing with the hassles of investing in farmland.

This is obvious but must be stated. Damage to crops & the land due to drought, floods, heat & freezing temperatures will not only cost the farmer his crops. It can also reduce farmland values & rents.

The best example of this is the dust bowl from 1934-1940. Agricultural land values were immediately, substantially, and persistently reduced.[10]

Now this is a once in a lifetime event but excessive heat, freezing temperatures & floods decimate crops every year.

Monsanto (now a part of Bayer) commonly sues farmers if any genetic material, which can be carried to adjacent farms by the wind or pollinating insects, is found in the crops of an unlicensed farm.[11]

Other examples include an outbreak in or around your farm could require crops to be destroyed. Farms could be put out of service until the problem has been taken care of as well.

The primary way to reduce legal liability is to hold the property in an LLC or some other legal entity that is separate from you. Only the assets held within the entity would be at risk, not your personal assets like your IRA, savings etc.

Disclaimer: I’m just a dude on the internet. I am not an attorney & all legal issues should be discussed with a qualified legal professional.

Tariffs, subsidies & regulations are all examples of government policies that can have a major impact on the farm business.

Many studies have concluded that government subsidies & tariffs are baked into the price of farmland. Rents, to a lesser extent, can also be affected.[12]

Because of this, undesirable changes to these policies can reduce farmland rents & land values across the nation.

One or more of these risks could put you in a position where you must cover the mortgage. If you are unable to do so, it could result in the bank foreclosing on your property.

To guard against this, you should have a larger cash reserve than you otherwise would have. If you would normally hold 3-4 months of living expenses in cash, you should probably bump that up to a minimum of 6 months.

We’ve already demonstrated that farmland values are incredibly resilient during both inflationary times & economic downturns. The one thing that seems to beat down farmland values, other than the great depression, are surpluses in agricultural output.

This is because surpluses of any kind put downward pressure on prices. If the price of your output goes down while the cost of your inputs remains the same (or goes down less or even up), your profitability falls. Do you think investors or famers are going to pay the same price for an asset if the profitability goes down?

There are 2 periods in particular:

- From 1921-1928, farmland values dropped 29% while the economy boomed & the stock market returned 202%

According to the USDA, “farm prices dropped due to huge agricultural surpluses, causing agricultural commodity prices and land values to drop steadily.”[13]

- From 1983-1987 farmland values dropped by 27% while the stock market increased by 76%

According to the USDA, the decrease was “due to surpluses, slowing inflation, and a general decrease in demand for agricultural land.” [13]

Unless you have significant experience investing in farmland, I strongly suggest you learn, learn & then learn some more before making your first purchase. In fact, you should never stop learning when it comes to farmland because it’s a very localized investment.

The county where your farm is located could enact new restrictions such as harsher operational standards, rent controls & much more. All of these could derail your expected returns from a farmland investment. Staying on top of such developments could be the difference between generating the returns that you expected when you purchased the property, & generating no return, or even a loss.

That wraps up the section on the risks of farmland investing. The final consideration for our analysis of an investment in farmland is about allocation.

What Allocation to Farmland is Best?

Here comes the cop out…I can’t say what is right for you because I’m not you. I don’t know your financial situation. I don’t know your required rate of return to meet your financial goals. Nor do I know anything about your ability or willingness to take risk.

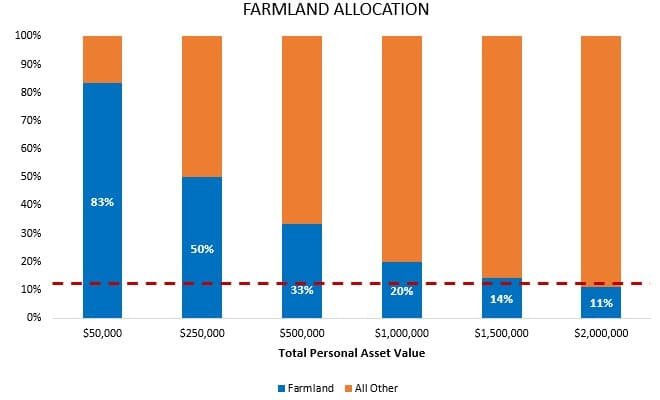

This is a decision you’ll have to make, but I think 10-20% is appropriate for most people. This is especially true for farmland given its long record of strong inflation adjusted performance & tons of intrinsic value.

Having said that, buying physical farmland presents one major challenge when it comes to deciding on an allocation %.

Because land can be quite expensive, a single investment property immediately becomes a very large portion of your portfolio.

For example, if you have $50k in assets & you buy a $250k plot of farmland, it immediately becomes 83% of your portfolio.

If you have $100k in assets, it’s still 75%. And with $500k it’s 33%.

You’d have to have assets of $1-2M for it to meet the 10-20% range.

The good news is that there are a couple ways around this allocation dilemma.

Not Investment Advice

None of this is investment advice or recommendations about which platforms, REITs, or stocks to invest in. I currently have no affiliation or interest in any aspect of any of these companies or investments. I’m just throwing them out as ideas so you can start your investigation into what method of farmland investing is best for you.

Under this arrangement, an entity buys the actual farmland & then sells portions of the land to investors. This helps smaller investors afford assets that are normally out of reach due to the large upfront cost.

This is similar to a mutual fund or REIT, but it’s marketed as owning your own piece of land. In fact, they may be legally considered a mutual fund or REIT if you read their filings with the SEC.

Just like anything in life, there are pros & cons to buying property through farmland investing platforms.

Pros

- Farmland crowdfunding platforms allow for a more passive approach

The fund handles the farm vetting process, they collect the rents & crop cash flow, & they handle any paperwork, tax filings & shareholder distributions.

- Invest for as little as $5k

There are farmland investing platforms that allow you to invest for this little. However, most require a minimum investment of $10-20k or more. This is still quite low compared to the $100k or more to truly own your own plot of farmland.

- Ability to invest in both debt & equity investments in farmland across the nation

Cons

- Extra fees

- Minimum hold periods of 5-10 years

Many of these farmland investing platforms require you to hold your investment for long periods of time. Some will allow an early exit, but it will come with stiff penalties.

- Rarely a secondary market to sell into

Meaning you should expect to hold on for the duration of the agreement.

- You’re typically buying shares of an LLC or other legal entity that owns the farmland

This means you don’t actually own any part of the farm. Instead, you own a claim to the cash flow & price appreciation recognized by a given investment. It’s not like you can get the title to your portion of the land you invested in.

- Most platforms are open to accredited investors only

This is true for platforms such as AcreTrader, FarmFundr, Farm Together & Farmland LP. The sites that offer investment to non-accredited investors include Harvest Returns, Steward, & Farmfolio.

Better yet, Steward offers some options with an initial investment as low as $100.

REIT stands for real estate investment trust. You’re investing in the shares of a publicly traded firm that buys the physical land & manages it for all the shareholders. Sound like a farmland crowdfunding platform yet?

You benefit from changes in the price of the shares of the REIT. Additionally, many farmland REITs pay a dividend yield significantly higher than the average stock. They can pull this off because they get tax benefits for paying out at least 90% of their taxable income.[14]

I prefer to invest in farmland REITs over farmland crowdfunding platforms for 4 reasons:

Pros

- The options are much greater than with farmland crowdfunding platforms.

This means the potential for greater diversification. They can hold just the land. It can rent the land to a farmer. They can participate in crop sharing. And it can invest in more than just farmland. There are many farmland REITs that invest in water rights, cooling facilities, processing plants, packaging facilities & distribution centers.

Also, most farmland REITs own several different properties across the nation. This can help diversify your exposure to specific land types, locations, crop types & more. Just make sure you’re aware of what your REIT holds. This helps you understand your risks and the extent of your diversification, or lack thereof.

- Much higher liquidity

They trade like stocks, so the liquidity is much higher than crowdfunding platforms.

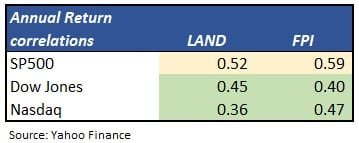

- Fairly low correlation to stocks

The good news is that the correlations of the top 2 farmland REITs (Farmland Partners (FPI) & Gladstone Land Corp (LAND)) are much lower than I thought they’d be. The correlation of annual returns range from about 0.4-0.6 which is considered fairly low.

- You can hold farmland REITs in a tax-sheltered account

Such as an IRA, or even better a Roth IRA, with no extra fees. This way you can defer or even avoid paying taxes on any of the prices gains or distributions.

Of course, you can hold physical farmland in an IRA too. The problem is there are so many hoops to jump through to do this. It increases the cost of investing in the asset which lowers your returns.

There are a few drawbacks to farmland REITs though.

Cons

- They are funds

Because of the way funds work, you can lose money by other investors selling their shares. Even if the price of the underlying asset stays the same. This is less of a possibility with farmland crowdfunding sites where you buy a portion of the actual asset.

- Some farmland REITs are not publicly traded

- They can have minimum hold periods

- They can have minimum investments amounts

- You don’t legally own the farms that you’re investing in

To avoid any surprises, make sure to do your due diligence & fully understand what you’re buying.

Some of the more popular farmland REITs include:

- Farmland Partners (FPI)

- Gladstone land Corp (LAND)

- Iroquois Farmland REIT

Depending on your goals, & your desire for liquidity, it’s up to you to decide which method of farmland investing is right for you. It could be physical farmland that you own personally. You could purchase shares through farmland crowdfunding platforms or farmland REITs. You can also invest in companies in the agriculture industry. There is also the option to invest in the debt of existing farm operations.

Hopefully this article gave you a solid background on the basics of farmland investing. If you have any questions, ideas for my next article, or if you’d like me to dig further into one of the topics that we discussed in this article, please leave a comment below.

Until then, you all take care and remember, wealth is not only about money & things. Your time & health are just as important and working to improve all 3 pillars of wealth is key to being adaptable, resilient & thriving in life.

[1] https://quickstats.nass.usda.gov/ . Accessed 11/26/2022

[2] https://www.barchart.com/futures/quotes/LE*0/historical-prices?viewName=main&orderBy=contractExpirationDate&orderDir=asc . Accessed 11/26/2022

[3] Publication 225 (2022), Farmer’s Tax Guide. https://www.irs.gov/publications/p225 . Accessed 11/26/2022

[4] Publication 946 (2021), How to Depreciate Property. https://www.irs.gov/publications/p946 . Accessed 11/26/2022

[5] Topic No. 409 Capital Gains & Losses. https://www.irs.gov/taxtopics/tc409 . Accessed 11/26/2022

[6] Ifft, J. and T. Kuethe. "The Ongoing Debate over Farmland Taxation." farmdoc daily (7):45, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 10, 2017. https://farmdocdaily.illinois.edu/2017/03/the-ongoing-debate-over-farmland-taxation.html. Accessed 11/26/2022

[7] USDA Farmers.Gov. https://www.farmers.gov/protection-recovery#protection. Accessed 11/26/2022

[8] New York Post. “DHS warns against mistrust of US government in latest terror bulletin.” https://nypost.com/2022/02/09/homeland-security-labels-conspiracy-theories-a-terror-threat/ Accessed 11/26/2022

[9] Center for Security Policy. “The Department of Homeland Security is telling you what is misinformation – Why you should be concerned.” https://centerforsecuritypolicy.org/the-department-of-homeland-security-is-telling-you-what-is-misinformation-why-you-should-be-concerned/Accessed 11/26/2022

[10] Hornbeck, Richard. 2012. “The Enduring Impact of the American Dust Bowl: Short- and Long-Run Adjustments to Environmental Catastrophe.” American Economic Review 102 (4) (June): 1477-1507. doi:10.1257/aer.102.4.1477. http://dx.doi.org/10.1257/aer.102.4.1477.. https://dash.harvard.edu/handle/1/11303325 Accessed 11/26/2022

[11] Monsanto sued small farmers to protect seed patents, report says. By Paul Harris. https://www.ers.usda.gov/webdocs/publications/87524/err-245.pdf?v=0 Accessed 11/26/2022

[12] Farmland Values, Land Ownership, and Returns to Farmland, 2000-2016. By Christopher Burns, Nigel Key, Sarah Tulman, Allison Borchers, and Jeremy Weber. https://www.ers.usda.gov/webdocs/publications/87524/err-245.pdf?v=0 Accessed 11/26/2022

[13] Publication: Trends in U.S. Agriculture. https://www.nass.usda.gov/Publications/Trends_in_U.S._Agriculture/Land_Values/index.php Accessed 11/26/2022

[14] How are REITs Taxed? (Including Implications of the 2017 Tax Cuts and Jobs Act). By April Thompson. https://www.reits.org/basics/reit-taxation/ Accessed 11/26/2022

Get Our Latest Delivered To Your Inbox

You will receive 1-2 emails per month and you can unsubscribe at anytime